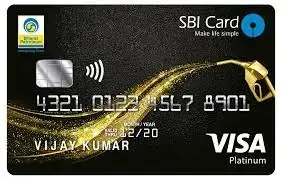

Do you want to save costs on regular expenses like gas and groceries? Well, look no further than the BPCL SBI Credit Card! This card is a collaboration between two big players, SBI Credit Card and Bharat Petroleum Corporation Limited (BPCL). It’s designed to tackle your fuel expenses head-on by giving you a whopping 13 reward points for every ₹100 you spend at BPCL stations.

That’s like getting 4.25% value back, which means more money in your wallet every time you fill up. And guess what? The benefits don’t stop there! The card goes the extra mile by waiving the 1% fuel surcharge on transactions up to ₹4,000, leading to further savings of up to ₹100 per month. That’s a cool ₹1200 saved annually just on fuel surcharge!

Beyond the pump, the BPCL SBI Credit Card proves its versatility. You’ll earn 1 reward point for every ₹100 spent on everyday purchases, from groceries and departmental stores to dining and entertainment. This means you can accumulate points on a wide range of expenses, making it a valuable tool for maximising your rewards potential. Whether you’re a driver on the go or a value-conscious shopper, the BPCL SBI Credit Card offers a winning combination of fuel savings and everyday rewards.

Table of Contents

- BPCL SBI Credit Card

- BPCL SBI Credit Card: Feed and Charges

- BPCL SBI Credit Card: Features and Benefits

- BPCL SBI Credit Card: Reward Offers

- BPCL SBI Credit Card: Travel Benefits

- BPCL SBI Credit Card: Fees and Charges

- BPCL SBI Credit Card: Terms and Conditions

- Who Can Apply for the BPCL SBI Credit Card?

- Documentation Needed for BPCL SBI Credit Card

- Application Process for the BPCL SBI Credit Card:

- FAQs on SBI BPCL Credit Card

BPCL SBI Credit Card

Joining Fee:

₹ 499 + GST

Best Suited :

Frequent fuel purchasers

Renewal Fee:

₹ 499 + GST

Reward Type:

Reward Point

Welcome Benefits:

2,000 bonus reward points worth Rs.500 on payment of the joining fee

BPCL SBI Credit Card: Feed and Charges

| Feature | Details |

|---|---|

| Interest Rates: | 3.5% per month (42% per annum) |

| Annual Fee: | Rs. 499 + taxes (waived on annual spending of Rs. 50,000) |

| Cash Advance Fee: | 2.5% of the transaction amount or Rs. 500 (whichever is higher) |

| Late Payment Fee: | ➡ Rs. 0 for the total amount due from Rs. 0 to Rs. 500. ➡ Rs. 400 for the total amount due above Rs. 500 and up to Rs. 1,000. ➡ Rs. 750 for the total amount due above Rs. 1,000 and up to Rs. 10,000. ➡ Rs. 950 for the total amount due above Rs. 10,000. |

| Overlimit Fee: | 2.5% of the over-limit amount (minimum Rs. 500) |

| Card Replacement Fee: | Rs. 100 |

| Foreign Currency Transaction Fee: | 3.5% of the transaction amount |

BPCL SBI Credit Card Benefits and Rewards

Fuel Savings:

#1. Up to 4.25% value back on fuel purchases at BPCL petrol pumps, including a 1% fuel surcharge waiver.

Reward Points:

- 10 reward points per Rs. 100 spent on groceries, departmental stores, movies, and dining.

- 1 reward point per Rs. 100 spent on non-fuel categories.

Welcome Benefits: 2,000 bonus reward points upon payment of the joining fee.

Annual Fee Waiver: Spend Rs. 50,000 in a year to get the annual fee of Rs. 499 waived.

Other Benefits:

- Contactless payment for quick and secure transactions.

- Fuel surcharge waiver across all BPCL petrol pumps in India.

- Easy redemption of reward points for fuel purchases at BPCL stations.

BPCL SBI Credit Card Details

- Fuel Savings: Up to 4.25% value back on fuel purchases at BPCL petrol pumps, including a 1% fuel surcharge waiver.

- Reward Points: Earn 10 reward points per Rs. 100 spent on groceries, departmental stores, movies, and dining.

- Welcome Benefits: Receive 2,000 bonus reward points upon payment of the joining fee.

- Finance Charges: Up to 3.35% per month (40.2% annually).

- Cash Advance Fee: 2.5% of the transaction amount or Rs. 500, whichever is higher.

- Late Payment Fee: Ranges from Rs. 0 to Rs. 950, based on the total amount due.

- Reward Redemption: Reward points can be redeemed for fuel purchases at BPCL petrol stations.

BPCL SBI Credit Card Advantages and Disadvantages

Advantages:

- Fuel Savings: Up to 4.25% value back on fuel purchases at BPCL petrol pumps.

- Reward Points: 10 reward points per Rs. 100 spent on groceries, departmental stores, movies, and dining.

- Welcome Benefits: 2,000 bonus reward points on payment of the joining fee.

- Annual Fee Waiver: Spend Rs. 50,000 in a year to waive the annual fee of Rs. 499.

- Fuel Surcharge Waiver: 1% waiver on fuel surcharge at BPCL pumps.

Disadvantages:

- Finance Charges: High finance charges of up to 3.35% per month (40.2% annually).

- Limited Reward Redemption: Reward points can only be redeemed for fuel at BPCL petrol stations.

- Foreign Transaction Fee: 3.5% of the transaction amount for foreign currency transactions.

- Late Payment Fee: Up to Rs. 950, depending on the total amount due.

BPCL SBI Credit Card: Features and Benefits

#1. Welcome Benefits:

- 2,000 reward points provide an initial boost to your reward points balance, translating into immediate benefits.

#2. Fuel Savings:

- Up to 4.25% value back on fuel purchases at BPCL petrol pumps.

- 1% fuel surcharge waiver, reducing overall fuel costs.

#3. Milestone Benefit:

- Earn 5,000 reward points on spending Rs. 3,00,000 annually, adding significant value for high spenders.

#4. Movie and Dining Benefits:

- Earn 10 reward points per Rs. 100 spent on movie tickets and dining, allowing cardholders to enjoy entertainment and dining out while accumulating points quickly.

#5. Annual Fee Waiver:Spending Threshold:

Spend Rs. 50,000 in a year to get the annual fee of Rs. 499 waived, making the card cost-effective for regular users.

BPCL SBI Credit Card: Reward Offers

- Get up to 4.25% cashback on your fuel purchases at BPCL petrol pumps. Plus, you’ll also enjoy a 1% fuel surcharge waiver on every fuel transaction, which means you can save big on your frequent drives.

- When you spend Rs. 100 on fuel at BPCL, you’ll earn 13 reward points. These points can be redeemed for fuel, giving you even more savings.

- Not only that, but you’ll also earn 10 reward points for every Rs. 100 spent on groceries and department store purchases.

- And here’s the best part: you’ll also earn 10 reward points for every Rs. 100 spent on movie tickets and dining.

- For all your other non-fuel purchases, you’ll still earn 1 reward point for every Rs. 100 spent. That means every expense contributes to your reward points balance, so you’ll always be working towards those rewards.

- And to kickstart your rewards journey, you’ll receive a generous welcome benefit of 2,000 reward points when you pay the joining fee.

- Finally, for those big spenders out there, if you spend Rs. 3,00,000 annually, you’ll earn a whopping 5,000 reward points. This milestone reward is designed to add significant value to your high expenditures, making it even more rewarding to spend big.

BPCL SBI Credit Card: Travel Benefits

The BPCL SBI Credit Card is primarily designed for fuel savings and everyday rewards, but it also offers a range of travel-related benefits to enhance your journey experience. Here are the travel benefits available with the BPCL SBI Credit Card:

- Fuel Savings on Road Trips:

- Fuel Savings: Earn up to 4.25% value back on fuel purchases at BPCL petrol pumps, making road trips more economical.

- Fuel Surcharge Waiver: 1% waiver on fuel surcharge at BPCL petrol stations, reducing the overall cost of travel.

- Reward Points for Travel Expenses: Earn 10 reward points per Rs. 100 spent on groceries, departmental stores, movies, and dining. These points can be accumulated and used to offset travel expenses such as dining during trips.

- Global Acceptance: The card is accepted worldwide, making it a reliable companion for international travel. Note that foreign currency transactions incur a fee of 3.5% of the transaction amount.

- Emergency Card Replacement: Cardholders can avail of emergency card replacement services, ensuring they are not stranded without access to funds during their travels.

- Travel Assistance Services: Access to a 24/7 helpline for assistance with travel-related queries and emergencies, providing peace of mind while on the go.

- Comprehensive Card Insurance: The card comes with various insurance covers, including lost card liability and fraud liability, offering protection against unforeseen travel incidents.

BPCL SBI Credit Card: Fees and Charges

- Joining Fee: The Rs. 499 + taxes fee is charged when you first get the card. As a welcome benefit, you receive 2,000 reward points upon payment of the joining fee.

- Annual Fee: The Rs. 499 + taxes annual fee is waived if you spend Rs. 50,000 or more in a year. This makes the card cost-effective for regular users.

- Finance Charges: Interest rate up to 3.35% per month (40.2% annually). These charges apply if you carry a balance on your card beyond the due date.

- Cash Advance Fee: 2.5% of the transaction amount or Rs. 500 (whichever is higher). This fee is charged when you withdraw cash using your credit card. Additionally, finance charges on cash advances start from the transaction date until the amount is paid in full.

- Late Payment Fee: Depending on the total amount due, the late payment fees are:

- Rs. 0 for a due amount of Rs. 0 to Rs. 500

- Rs. 400 for a due amount above Rs. 500 and up to Rs. 1,000

- Rs. 750 for a due amount above Rs. 1,000 and up to Rs. 10,000

- Rs. 950 for a due amount above Rs. 10,000

- Overlimit Fee: 2.5% of the over-limit amount (minimum Rs. 500). This fee is charged if your card usage exceeds the set credit limit.

- Card Replacement Fee: This Rs. A 100 fee applies if you request a replacement card due to loss or damage.

- Foreign Currency Transaction Fee: 3.5% of the transaction amount. This fee is charged on transactions made in foreign currencies. It includes the cost of converting the foreign currency into Indian Rupees.

- Cash Payment Fee: This Rs. 199 fee is charged if you make a cash payment towards your credit card bill at SBI branches or through other payment channels that accept cash payments.

- Statement Retrieval Fee: This Rs. 100 per statement fee is charged if you request a physical copy of your credit card statement for previous months.

- Payment Dishonor Fee: 2% of the payment amount (minimum Rs. 450). This fee is charged if a cheque or other payment instrument is returned unpaid.

BPCL SBI Credit Card: Terms and Conditions

- Transactions: Enabled for contactless payments up to Rs. 2,000 without PIN.

- Payment: Cardholders must ensure timely payment of dues to avoid penalties and interest charges.

- Card Cancellation: SBI can suspend or cancel the card at its discretion with due notice.

- Billing Disputes: Any discrepancies in the billing statement should be reported within 30 days from the statement date.

- Late Payment Fee: Ranges from Rs. 0 to Rs. 950, based on the total amount due.

- Redemption: Reward points can be redeemed for fuel purchases at BPCL petrol pumps and other options available on the SBI Card portal.

- Payment Methods: Online through the SBI Card website, mobile app, NEFT, or through cheques and cash at SBI branches.

- Changes: SBI Card reserves the right to change the terms and conditions, fees, and charges associated with the card. Cardholders will be notified of such changes.

Who Can Apply for the BPCL SBI Credit Card?

The BPCL SBI Credit Card offers substantial benefits, especially for those who frequently spend on fuel and other everyday categories. To qualify for this card, applicants must meet specific eligibility criteria. Here’s a detailed, statistics-based overview:

- Age Requirement: 18 years old typically up to 65 years.

- Income Criteria: Minimum monthly income of Rs. 20,000 or higher. Exact requirements may vary based on location and applicant profile.

- Employment Status:

- Salaried Individuals: Must provide proof of steady employment, such as recent salary slips and employment certificates.

- Self-Employed Individuals: Must show proof of business ownership and consistent income, such as IT returns and bank statements.

- Credit History: A minimum CIBIL score of 700 is typically required.

- Resident Status:

- Indian Residents: Must be a resident of India.

- Non-resident Indians (NRIs): May be eligible under specific conditions set by the SBI Card.

Documentation Needed for BPCL SBI Credit Card

Applying for the SBI BPCL Credit Card requires the submission of specific documents to verify the applicant’s identity, address, and income. Here is a detailed overview of the required documentation:

1. Identity Proof:

- Aadhaar Card: A government-issued unique identification number.

- PAN Card: Permanent Account Number issued by the Income Tax Department.

- Passport: A valid passport serving as proof of identity and nationality.

- Voter ID Card: Issued by the Election Commission of India.

- Driving License: A valid driver’s license with a photo ID.

2. Address Proof:

- Utility Bills: Recent electricity, water, or gas bills (not older than three months).

- Aadhaar Card: If the address is updated and matches the application.

- Passport: If the address is current.

- Rent Agreement: A registered rent agreement.

- Bank Statement: A recent bank statement showing the applicant’s current address.

3. Income Proof for Salaried Individuals:

- Salary Slips: Recent salary slips for the last three months.

- Form 16: Issued by the employer for the previous financial year.

- Bank Statements: Bank statements for the last three to six months showing salary credits.

4. Income Proof for Self-Employed Individuals:

- Income Tax Returns (ITR): Filed returns for the last two years.

- Bank Statements: Bank statements for the last six months showing business income.

- Business Continuity Proof: Business registration documents or trade license.

5. Additional Documents:

- Photographs: Recent passport-sized photographs.

- Signature Proof: Signature verification from the bank or on a cheque.

Application Process for the BPCL SBI Credit Card:

- Online Application: Visit the SBI Card website or mobile app to fill out the application form for the BPCL SBI Credit Card.

- Verification: Provide accurate personal details and contact information during the application process.

- Approval Time: Typically, the approval process takes about 7-10 working days, subject to verification and credit checks.

- Welcome Communication: Upon approval, receive a confirmation email or SMS with details about the approved credit limit and expected delivery of the card.

- Card Activation: Once the card is received, activate it by following the instructions provided, usually through the SBI Card website or customer care.

FAQs on SBI BPCL Credit Card

Q1. What are the primary benefits of the BPCL SBI Credit Card?

A1. The BPCL SBI Credit Card offers some great perks. You can get up to 4.25% value back on fuel purchases at BPCL petrol pumps, and you’ll also earn reward points on groceries, dining, and more. Plus, there are welcome benefits and annual milestone rewards to look forward to.

Q2. How can I apply for the BPCL SBI Credit Card?

A2. Applying for the BPCL SBI Credit Card is a breeze. You can do it online through the SBI Card website or mobile app. Just fill out the application form, make sure to provide accurate details, and then all you have to do is wait for approval.

Q3. What documents are required to apply for the BPCL SBI Credit Card?

A3. To apply for the BPCL SBI Credit Card, you’ll need a few important documents. Make sure to have your identity proof handy, like your Aadhaar card or PAN card. You’ll also need address proof, such as utility bills or a rent agreement, and income proof, like salary slips or income tax returns.

Q4. What fees and charges are associated with the BPCL SBI Credit Card?

A4. When it comes to fees and charges, here’s the lowdown on the BPCL SBI Credit Card. There’s a joining fee of Rs. 499 + taxes, and an annual fee of Rs. 499 + taxes (but don’t worry, this fee is waived if you spend Rs. 50,000 or more in a year). And if you have any outstanding balance, you’ll be charged a monthly finance fee of up to 3.35%, among other charges. So be sure to keep track of those fees.

Q5. How long does it take to get approval for the BPCL SBI Credit Card?

A5. Typically, the approval process takes about 7-10 working days, depending on verification and credit checks. Applicants will receive communication regarding the status of their application once it is processed.