BoB Financial is a non-banking financial company that is a part of the Bank of Baroda and specialises in credit cards. This leading credit card issuer was founded in 1994 and has become one of the fastest-growing companies in India since then. The company is governed by India’s leading banks which ensures various types of shopping, travel, dining or lifestyle are made more accessible through their broad spectrum for different needs.

UPI payments can be made conveniently by connecting your Bank of Baroda credit card through it. According to the data released by RBI, till January 2024, there were over 23 million active BoB Financial credit card users across the country. Customer satisfaction is the core objective of this expanding company. The banking institution has made every credit card available with many attractive features and benefits that would effectively meet the diverse needs of the people.

Table of Contents

- Top 10 Bank of Baroda Bank Credit Cards in 2024

- 1. Bank of Baroda Premier Credit Card

- 2. Bank of Baroda Easy Credit Card

- 3. Bank of Baroda Select Credit Card

- 4. IRCTC BoB RuPay Credit Card

- 5. Bank of Baroda Prime Credit Card

- 6. HPCL Bank of Baroda ENERGIE Credit Card

- 7. Bank of Baroda Eterna Credit Card

- 8. Snapdeal Bank of Baroda Credit Card

- 9. Bank of Baroda Unnati Credit Card

- 10. Bank of Baroda Varunah Credit Card

- Bank of Baroda Credit Card Features and Benefits

- Bank of Baroda Credit Card Rewards and Cashback

- 1. Bank of Baroda Premier Credit Card

- 2. Bank of Baroda Easy Credit Card

- 3. Bank of Baroda Select Credit Card

- 4. IRCTC BoB Rupay Credit Card

- 5. Bank of Baroda Prime Credit Card

- 6. HPCL BoB ENERGIE Credit Card

- 7. Bank of Baroda ETERNA Credit Card

- 8. Bank of Baroda Easy Credit Card

- 9. BoB Swavlamban Credit Card

- 10. BoB Varunah Credit Card

- 11. BoB Indian Army Yoddha Credit Card

- 12. BoB ICAI Exclusive Credit Card

- How To Earn and Redeem Bank of Baroda Credit Card Reward Points?

- Bank of Baroda Bank Credit Card Eligibility Criteria

- Bank of Baroda Credit Card Annual Fees and Charges

- Other Fees & Charges

- How To Activate Bank of Baroda Credit Cards?

- Bank of Baroda Credit Cards Login/Net Banking

- How To Compare Bank of Baroda Credit Cards & Choose The Best One?

- Conclusion

- Important Links

- FAQs on Bank of Baroda Credit Cards

Top 10 Bank of Baroda Bank Credit Cards in 2024

1. Bank of Baroda Premier Credit Card

Bank of Baroda Premier Credit Card provides you with special rewards and benefits in different categories. You get 2 points for every Rs. 100 spent. Besides, there are extra points for dining, travel, and international purchases. Some of its features include redeemable points for cash back, free access to the airport lounge, 24/7 concierge service, a 1% fuel surcharge waiver, etc.

Bank of Baroda Premier Credit Card

Joining Fee:

₹ 1,000 + GST

Best Suited For:

Travel

Renewal Fee:

₹ 1,000 + GST

Reward Type:

Reward Points

Welcome Benefits:

N/A

Key Features

- You get 1 complimentary domestic lounge access every quarter at select airports using a Bank of Baroda Premier credit card.

- The cardholders will get a 1% fuel surcharge waiver on fuel transactions at all fuel stations across India. The waiver is applicable on transactions ranging between ₹400 to ₹5,000.

- The fuel surcharge waiver is capped at ₹250 per month

- You get insurance benefits covering personal accident death cover along with zero liability coverage in case of loss or theft of a card.

- You can get up to 3 free add-on cards on this credit card.

*Terms and Conditions apply.

2. Bank of Baroda Easy Credit Card

Perfect for everyday shopping, the Bank of Baroda Easy Credit Card provides reward points on various shopping categories without any joining or renewal fees, making it an economical choice for regular shoppers.

Joining Fee:

Nil

Best Suited For:

Shopping

Renewal Fee:

Nil

Reward Type:

Reward Points

Welcome Benefits:

N/A

Key Features

- This credit card offers accidental death cover to the primary credit cardholder.

- You can link this card on your UPI application like Google Pay and earn base Reward Points on UPI spends.

- On this card, you get the benefit of zero liability on the lost card. The cardholder has to notify the bank within 24 hours about the loss of the card or any other fraudulent transactions.

- You can easily convert your purchase worth more than Rs. 2,500 into easy EMIs of 6/12 months.

- The gathered reward points can be redeemed against cash-backs and other exciting options.

- The monetary value of 1 Reward Point is equal to Rs. 0.25.

*Terms and Conditions apply.

3. Bank of Baroda Select Credit Card

The Bank of Baroda Select Credit Card, which is issued by BoB Financial, comes with lots of benefits and attractive rewards. The cardholder accumulates reward points on every spending: dining, utility bills and online purchases earn extra points. Besides that, there are also other offers such as getting 1000 bonus rewards every month, cashback against points redemption in different categories like entertainment shopping and much more.

Joining Fee:

₹ 750 + GST

Best Suited For:

Shopping

Renewal Fee:

₹ 750 + GST

Reward Type:

Reward Points

Welcome Benefits:

N/A

Key Features

- You get an accidental death insurance cover through your Bank of Baroda Select Credit Card.

- 1% fuel surcharge waiver across all fuel pumps for every transaction between Rs. 400 & Rs. 5,000.

- The maximum waiver is capped at Rs. 250 per month for the Bank of Baroda Select Credit Card.

- The Reward Points earned are redeemable against cash or several different options as per your choice.

- 1 Reward Point = Rs. 0.25.

*Terms and Conditions apply.

4. IRCTC BoB RuPay Credit Card

The IRCTC BoB RuPay Credit Card is a partnership between IRCTC and BoB Financial with a joining fee of Rs. 500 as well as an annual fee of Rs. 350, which gives great rewards for railway ticket bookings made on their site. This includes 1,000 bonus reward points upon signup up to 40 per Rs 100 spent elsewhere, along with four free visits at any domestic lounge. Other such amenities include 1% fuel surcharge waiver, or even railway surcharges waived off.

Joining Fee:

₹ 500 + GST

Best Suited For:

Travel

Renewal Fee:

₹ 350 + GST

Reward Type:

Reward Points

Welcome Benefits:

1000 Bonus Reward Points on spending Rs. 1000 within 45 days

Key Features

- As a joining benefit, you get 1000 bonus Reward Points on the condition that you should do a single transaction of Rs. 1000 through your card within the first 45 days of card issuance.

- Up to 40 Reward Points per Rs. 100 you spend while booking railway tickets through the IRCTC website or mobile application.

- 4 Reward Points per Rs. 100 spent towards grocery and departmental stores.

- You are entitled to 4 Complimentary domestic railway lounge access per year, subject to a maximum of 1 per quarter.

- Get a fuel surcharge waiver of 1% on all fuel transactions between Rs. 500 to Rs. 3,000 at fuel pumps all over India (waiver capped at Rs. 100 per statement).

- On booking a railway ticket through IRCTC Website or Mobile Application using IRCTC BoB RuPay Credit Card, you are entitled to a transaction surcharge waiver of 1% on all transactions.

*Terms and Conditions apply.

5. Bank of Baroda Prime Credit Card

The Bank of Baroda Prime Credit Card is a secured credit card available with a fixed deposit, so you don’t need to show proof of income. There is no admission charge for this facility, and it provides special benefits that include 5x reward points on particular offers. Additional advantages are receiving the card against a fixed deposit of Rs. 15,000 with no entry or yearly dues, redeemable points in different categories, round-the-clock concierge services and a waiver on 1% fuel surcharge among others.

Joining Fee:

Nil

Best Suited For:

Shopping

Renewal Fee:

Nil

Reward Type:

Reward Points

Welcome Benefits:

N/A

Key Features

- With the Prime credit card issued by Bank of Baroda, you get free personal insurance to cover your losses and damages suffered.

- You get a waiver of the 1% fuel surcharge on all fuel transactions between Rs 400 and Rs 5,000. The cardholders can get a maximum waiver of up to Rs 250 per statement cycle.

- You get zero liability coverage on fraudulent/unauthorized transactions made on a stolen/lost card if the loss is reported to the bank in a timely manner.

- You can convert your purchase of more than Rs 2500 into an EMI transaction on this credit card

- The reward points earned by the cardholders using the Prime Card can be redeemed by logging into your Internet banking account.

- You can redeem your earned points against several categories at a rate of 1 RP = Re. 0.25

*Terms and Conditions apply.

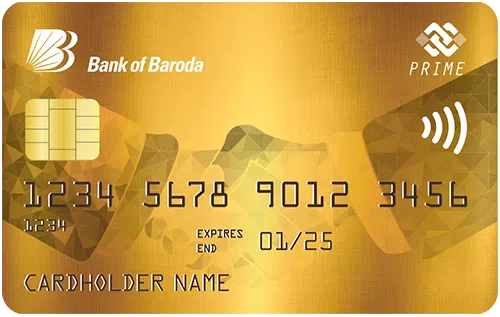

6. HPCL Bank of Baroda ENERGIE Credit Card

Ideal for frequent drivers, the HPCL BoB ENERGIE Credit Card offers rewards on fuel spending and a bonus for initial spending within the first 60 days. You can have savings of around ₹12,000 every year with this card.

Joining Fee:

₹ 499 + GST

Best Suited:

Fuel

Renewal Fee:

₹ 499 + GST

Reward Type:

Reward Points

Welcome Benefits:

2,000 Bonus Reward Points on spending Rs. 5,000 within the first 60 days

Key Features

- As a welcome benefit, the cardholders are entitled to get 2,000 joining Reward Points if they are able to successfully spend Rs. 5,000 using their credit card within 60 days of the date of card issuance.

- With the HPCL Bank of Baroda ENERGIE Credit Card, you get access to partnered domestic airport lounges once every quarter

- If you purchase 2 movie tickets via Paytm Movies using this credit card, you get a discount of 25% (a maximum of Rs. 100).

- The renewal fee of Rs. 499 of the HPCL Bank of Baroda ENERGIE Credit Card can be waived off on successful spending of Rs. 50,000 in an anniversary year.

- Up to 3 free lifetime credit cards can be availed.

*Terms and Conditions apply.

7. Bank of Baroda Eterna Credit Card

Best for premium shoppers, the BoB Eterna Credit Card offers significant rewards and benefits, including a FitPass Pro membership and bonus reward points. With this, you can enjoy high-quality travel, dining & shopping experiences.

Joining Fee:

₹ 2,499 + GST

Best Suited:

Shopping

Renewal Fee:

₹ 2,499 + GST

Reward Type:

Reward Points

Welcome Benefits:

6-month FitPass Pro membership and 10,000 bonus reward points

Key Features

- You get 20,000 bonus reward points on the annual expenditure of Rs. 5 lakh.

- The joining fee is waived on spending Rs. 25,000 in the first 60 days of card issuance.

- The subsequent year’s annual fee is waived if Rs. 2.5 lakh were spent in the previous year.

- Accelerated reward points (15/Rs. 100) on travel-related spends.

- Personal air accident covers worth Rs. 1 crore (applicable only in case of loss of life).

- 1% of the fuel surcharge was waived on fuel purchases at all petrol/gas stations across India for transactions between Rs. 400 and Rs. 5,000. The maximum waiver is capped at Rs. 250 per month.

*Terms and Conditions apply.

8. Snapdeal Bank of Baroda Credit Card

Designed for Snapdeal shoppers, this card provides a gift voucher as a welcome benefit and rewards on Snapdeal purchases. Plus, from the date of any transaction, you can get up to 50 days of interest-free credit.

Joining Fee:

₹ 249 + GST

Best Suited:

Shopping

Renewal Fee:

₹ 249 + GST

Reward Type:

Reward Points

Welcome Benefits:

Snapdeal gift voucher worth up to Rs. 500

Key Features

- As an introductory benefit, the cardholders get a Snapdeal voucher worth up to Rs. 500 on making at least one transaction within the first 30 days of card issuance.

- The cardholder gets a 1% fuel surcharge waiver on all fuel transactions between Rs. 400 and Rs. 5,000.

- The maximum benefit under this waiver is capped at Rs. 250 per month.

- With this BoB Snapdeal Credit Card, the cardholders get zero liability protection, i.e, the cardholders won’t be liable for any unauthorized/fraudulent purchases made on a lost/stolen card if reported to the bank in a timely manner.

- The Reward Points earned using the Snapdeal Bank of Baroda Credit Card are automatically adjusted against the card’s outstanding balance at the end of each statement cycle. The monetary value of 1 Reward Point is equal to Re. 0.25.

*Terms and Conditions apply.

9. Bank of Baroda Unnati Credit Card

BoB Financial has partnered with CreditAI to present the Bank of Baroda Unnati Credit Card for farmers only. This is a lifetime-free card and is intended to meet the credit requirements of farmers at a nominal cost. It has a fair reward rate coupled with an extremely low interest rate which makes it possible for farmers to afford using this card’s credit facilities. Although it does not support or allow cash withdrawals, international transactions or the purchase of fuel, it effectively caters for the specific needs of farmers and similar target audiences.

Bank of Baroda Unnati Credit Card

Joining Fee:

Nil

Best Suited:

Shopping

Renewal Fee:

Nil

Reward Type:

Reward Points

Welcome Benefits:

N/A

Key Features

- The cardholders get 1 Reward Point on every spend of Rs. 100.

- The number of Reward Points that can be earned per statement cycle is capped at 800 Reward Points.

- The Reward Points can be redeemed against the card’s outstanding balance.

- 1 Reward Point = Re. 0.25.

- To help all the farmers out there, the Unnati Card by BoB comes with a reduced interest rate of 1.5% per month only. It is lower than most of the other credit cards in the Indian market.

*Terms and Conditions apply.

10. Bank of Baroda Varunah Credit Card

Available in three variants, the Varunah Credit Card offers exclusive benefits like complimentary memberships and bonus reward points, making it ideal for premium shoppers.

Bank of Baroda Varunah Credit Card

Joining Fee:

Nil (Varunah Card), Rs. 1,499 (Varunah Plus), Rs. 2,499 (Varunah Premium)

Best Suited:

Shopping

Renewal Fee:

Nil (Varunah Card), Rs. 1,499 (Varunah Plus), Rs. 2,499 (Varunah Premium)

Reward Type:

Reward Points

Welcome Benefits:

Complimentary Amazon Prime & Zomato Pro membership, Fitpass Pro membership, and 1,000 bonus Reward Points (Varunah Premium)

Key Features

- Complimentary 12 months Amazon Prime membership (with the Premium and Plus variant).

- The travel benefits offered by the BoB Varunah Credit Cards.

- Get unlimited complimentary domestic lounge access every year.

- Get a lower forex markup fee of 2% only.

- Get 3 complimentary domestic lounge access every quarter.

- Lower forex markup fee of 2.5% only.

- The cardholders get a 1% fuel surcharge waiver on all fuel transactions between Rs. 400 and Rs. 5,000. The maximum waiver is capped at Rs. 250 per statement cycle

*Terms and Conditions apply.

Bank of Baroda Credit Card Features and Benefits

As with other large credit card providers in India, BoB Financial also has various features and benefits for its credit cards. While each card is different from one another, most of the BoB cards come with the following common advantages:

1. Welcome Benefits: The cardholder gets welcome benefits such as bonus reward points, vouchers, premium memberships with partner brands or accelerated cashback on payment of the card membership fee.

2. Reward/Cashback: Every transaction made using a BoB Credit Card earns cardholders either reward points or cashback. Some cards provide more rewards or cash back for specific categories, and there are different options through which one can redeem these points.

3. Milestone Benefits: Bonus reward points, cashback or gift vouchers become available once certain spending limits are reached by individuals who possess BoB credit cards.

4. Travel Benefits: These include free entry into airport lounges as well as discounts off bookings which are given by some BoB cards targeting travelers.

5. Movie & Dining Benefits: BoB offers entertainment perks like free or discounted movie tickets and dining privileges to their customers.

6. Other Benefits: Additional advantages are also offered such as exemption from fuel surcharge along with chances for getting annual fees waived based on expenditure amounts and so on.

Bank of Baroda Credit Card Rewards and Cashback

Each BoB Financial credit card is designed to provide customers with the best reward rates. Different expenses can earn reward points, cashback, or miles with some. While most BoB Credit Cards give reward points mainly, they do so at different rates in various spending categories.

Ordinarily, cards that attract lower annual charges have few benefits attached to them per expenditure. Conversely, higher annual fee cards have more benefits for each spending item, as seen in the rates below for top BoB Credit Cards:

1. Bank of Baroda Premier Credit Card

- Rewards: 2 points per Rs. 100 on general spending.

- 10 points per Rs. 100 on travel, dining, and international transactions.

2. Bank of Baroda Easy Credit Card

- Rewards: 1 point per Rs. 100 on general spends

- 5 points per Rs. 100 on departmental stores, groceries, and movies.

3. Bank of Baroda Select Credit Card

- Rewards: 1 point per Rs. 100 on general spends

- 5 points per Rs. 100 on dining, online shopping, and utility bill payments.

4. IRCTC BoB Rupay Credit Card

- Rewards: Up to 40 points per Rs. 100 on IRCTC railway tickets

- 4 points per Rs. 100 on groceries and departmental stores

- 2 points per Rs. 100 on other expenses.

5. Bank of Baroda Prime Credit Card

- Rewards: 4 points per Rs. 100 on all spends.

6. HPCL BoB ENERGIE Credit Card

- Rewards: 24 points per Rs. 150 on fuel at HPCL pumps

- 4 points per Rs. 150 on groceries and departmental stores

- 2 points per Rs. 150 on other spends.

7. Bank of Baroda ETERNA Credit Card

- Rewards: 15 points per Rs. 100 on dining, travel, online shopping, and international transactions

- 3 points per Rs. 100 on other categories.

8. Bank of Baroda Easy Credit Card

- Rewards: 1 point per Rs. 100 on general spends

- 5 points per Rs. 100 on departmental stores, groceries, and movies

9. BoB Swavlamban Credit Card

- Rewards: Up to 15 points per Rs. 100 with the Varunah Premium Card

- Up to 10 points with the Varunah Plus Card

- Up to 5 points with the Varunah Card.

10. BoB Varunah Credit Card

- Rewards: Up to 15 points per Rs. 100 with the Varunah Premium Card.

- up to 10 points with the Varunah Plus Card; up to 5 points with the Varunah Card.

11. BoB Indian Army Yoddha Credit Card

- Rewards: 2 points per Rs. 100 on retail spends.

- 10 points per Rs. 100 on departmental stores and groceries.

12. BoB ICAI Exclusive Credit Card

- Rewards: 1 point per Rs. 100 on general spends.

- 5x points on dining, utility bills, and online purchases.

How To Earn and Redeem Bank of Baroda Credit Card Reward Points?

Bank of Baroda gives various types of credit cards, including co-branded ones; therefore, the redemption process for reward points may differ. On their official website, those who have earned can be exchanged for different things.

Do not forget that these points expire after some time; hence, make sure you redeem them before it’s too late. Also, it is important for you to read through all terms and conditions provided on the bank’s site before starting off your redemption process.

Redeeming Reward Points for Bank Of Baroda

- Step 1: Go to Bank of Baroda’s Official Page: Visit their site at https://www.bankofbaroda.in/

- Step 2: Login: Enter your user ID & password in order to access this service

- Step 3: Choose Redemption Category: Select the category under which you would like to redeem points

- Step 4: Add Items to Cart: Pick items that catch your eye for purchase

- Step 5: Redeem Points: Click on “Redeem Points” button and specify how many of them should be used up

- Step 6: Checkout: Proceed with further instructions until the completion of the transaction process.

- Step 7: Agree To Terms: Tick the box next “I agree with terms” then hit “Redeem” button so that everything is finalized.

Bank of Baroda Bank Credit Card Eligibility Criteria

Each credit card company has its own set of requirements that must be met by the applicants. BoB Financial Credit Cards also follow this rule. For BoB Financial Credit Cards, the eligibility depends on income level, age and credit score, among other things. The main requirements include:

1. Age: The minimum age limit is 21 years (18 years in case of other cards) while maximum age is not beyond 65 years.

2. Income: A person should have a regular income source.

3. Credit Score: Applicants need to have a good credit history.

There are different criteria for user-specific cards, which can be found on respective card pages.

Documents Required

While applying for these cards of the Bank of Baroda, specific documents need to be uploaded or submitted along with the application form, or the application will not be processed further.

1. Identity Proof: PAN Card, Aadhaar Card, Voter ID, Passport or Driving Licence.

2. Address Proof: To prove residence, one can submit any among Aadhaar Card, Voter ID, Passport or Driving Licence.

3. Income Proof: The latest Salary Slip showing deductions, if applicable (for last 2 months), would be required from salaried individuals, while self-employed persons must furnish their ‘latest ITR’ as proof of income earned through business or profession being carried on by them.

Bank of Baroda Credit Card Annual Fees and Charges

Different credit cards issued by BoB Financial come with varying annual fees, which are crucial factors for applicants when selecting a suitable card. Generally, higher annual fees correlate with better features and benefits. Below is an overview of the annual fees for some of the best BoB credit cards:

Here’s the content formatted into a table:

| Credit Card | Annual Fee |

|---|---|

| Bank of Baroda ETERNA Credit Card | Rs. 2,499 (waived on spending Rs. 2,50,000 in the previous year) |

| Bank of Baroda Select Credit Card | Nil |

| Bank of Baroda Premier Credit Card | Nil |

| IRCTC BoB Rupay Credit Card | Rs. 500 (joining fee), Rs. 350 (annual fee) |

| Bank of Baroda Prime Credit Card | Nil |

| HPCL BoB ENERGIE Credit Card | Rs. 499 |

| Bank of Baroda Easy Credit Card | Nil |

| BoB Swavlamban Credit Card | Nil |

| BoB Varunah Credit Card | Nil (for Varunah Card), Rs. 1,499 (for Varunah Plus Card), Rs. 2,499 (for Varunah Premium Card) |

| BoB Indian Army Yoddha Credit Card | Nil |

| BoB ICAI Exclusive Credit Card | Nil |

| BoB ConQR Credit Card | Nil |

Other Fees & Charges

- Interest Charges: 3.25% per month for all BoB Credit Cards

- Cash Advance Fee: 2.5% of the withdrawn amount or Rs. 500 (whichever is higher)

- Forex Markup Fee: 2% for the Eterna Card and 3.5% for all other cards

These fees and charges should be carefully considered by potential cardholders before applying for a BoB credit card.

How To Activate Bank of Baroda Credit Cards?

#1. Netbanking:

- Step 1: Register or Log In: Register on the Bank of Baroda website or log in if already registered.

- Step 2: Generate PIN: Receive an OTP on your registered mobile number to generate the PIN.

- Step 3: Enter Card Details: Fill in your credit card number, CVV, expiry date, and birth date.

- Step 4: Verify OTP: Enter the OTP for verification.

- Step 5: Submit: Ensure all details are correct and submit.

#2. Mobile Banking:

- Step 1: Download App: Install the ‘Bank of Baroda’ app from Google Play or Apple Store.

- Step 2: Log In: Use your credentials to log in.

- Step 3: Select Credit Card: Choose your card under ‘Select Credit Cards’ and go to ‘Service Request’.

- Step 4: Generate PIN: Select your card and click ‘Generate Credit Card PIN’.

- Step 5: Enter Details: Enter card number, CVV, expiry date, and birth date.

- Step 6: Verify OTP: Enter the received OTP and confirm.

#3. ATM:

- Step 1: Visit ATM: Go to a nearby Bank of Baroda ATM.

- Step 2: Insert Card: Insert your card into the machine.

- Step 3: Provide Details: Enter your card details and OTP sent to your mobile.

- Step 4: Generate PIN: Follow the prompts to set your new PIN.

#4. Customer Care:

- Step 1: Call Hotline: Dial 1800 103 1006 or 1800 22 5100.

- Step 2: Provide Details: Give your card information and birth date.

- Step 3: Follow Instructions: Follow the representative’s instructions to activate your card.

Bank of Baroda Credit Cards Login/Net Banking

If you’re a Bank of Baroda debit cardholder, you can easily register for net banking using these steps:

- Step 1: Visit Website: Go to the BoB Internet Banking page.

- Step 2: Access Credit Cards: Click on ‘Credit Cards’ under the ‘Login’ option.

- Step 3: Register Your Card: Select ‘Register Your Card.’

- Step 4: Provide Details: Enter your credit card number, expiry date, and other necessary details, then click ‘Proceed.’

How to Login to Bank of Baroda Credit Card Netbanking?

Once you’ve registered your BoB Credit Card for internet banking, follow these steps to log in:

- Step 1: Visit Website: Go to the BoB net banking page and click on ‘Login.’

- Step 2: Access Credit Cards: Choose the ‘Credit Cards’ option.

- Step 3: Enter Credentials: You’ll be directed to a new login page. Enter your username and password.

- Step 4: Login: Click on ‘Login’ to access all the features and benefits of BoB Credit Card internet banking.

How To Compare Bank of Baroda Credit Cards & Choose The Best One?

It’s wise to consider the following factors while comparing and searching for the best IndusInd Bank credit card for you:

1. Evaluate What You Need: This involves knowing your spending habits as well as financial objectives so that you can easily tell the kind of rewards or benefits most important to you- cashback, travel privileges among others.

2. Check Out Card Features: Look at different BoB credit cards’ main aspects like yearly charges imposed on the user interest rates charged by them per month, if any, the larger, the better for someone who intends not to pay all his/her debts at a go reward system employed which could either be points based or cash-oriented plus any additional perks such as airport lounge access and insurance covers attached to each of these cards.

3. Use Comparison Tools: Utilize comparison utilities found on Bank of Baroda’s official site or famous financial comparison platforms that will enable you to judge several cards at once side by side against one another.

4. Read Reviews from Clients: Go through feedback given out by customers who have had the chance to use any Bob credit card in order to get an idea about overall satisfaction levels as well as experiences among different holders so far.

5. Consult Professionals: Seek advice from experts within this field or visit the nearest branch office near where you live so as to seek clarifications on any matter bothering your mind concerning these facilities and even have them give some suggestions depending on their knowledge bank regarding what would work out best for each consumer group.

6. Decide Wisely: Having done all necessary background checks, like doing a thorough investigation coupled with critical thinking, ensure that you finally settle for only that particular Bob credit card which suits not only your economic needs but also your lifestyle.

Conclusion

Bank of Baroda (BoB) credit cards offer an extensive range of benefits that are carefully designed to match various styles and preferences. It could be the attraction of earning reward points, enjoying cash-back facilities or experiencing exclusive travel privileges; these cards are flexible financial instruments for meeting a wide array of needs.

To choose the most suitable BoB credit card which not only meets customer needs but also maximises financial capability, one needs to compare them against each other in terms of features and know eligibility requirements very well. People can spend smarter, get more rewards and grow financially stronger by using BoB credit card options that are at their disposal and move towards greater success.

Important Links

Airport Lounge

Forex Charges

RuPay Cards

FAQs on Bank of Baroda Credit Cards

Q1. What are the requirements to get a BoB credit card?

A1. If you want to apply for a credit card from BoB, you must satisfy such conditions as age (usually 18 years old), stable income, and good credit history. The eligibility criteria for each particular type of card may differ.

Q2. How do I accumulate and use rewards on my BoB bank cards?

A2. Earn points, cash back, or any other bonuses allowed by using your BoB credit card when paying for purchases. These points usually can be exchanged for different privileges: gift certificates, goods, statement credit, etc.

Q3. What other charges should I know about if I have BoB bank credit cards?

A3. Except for the annual fee, there could be such payments as interest rates on unpaid balances, cash advance fee, late payment fee, foreign transaction fee on Bob Financial credit cards. It is important to read carefully through all terms and conditions applicable to your card in order not to miss any necessary information about fees.