The Axis Bank Privilege Credit Card enjoys a good market share in the domain of premium credit cards. The presence of these possibilities has been attracting much interest to the card due to the prospects for unlimited rewards and free travel.

The Privilege Credit Card, unlike many of the competitors that offer bonus points only in certain specified categories, provides edge reward points at a fixed 10 points for every Rs. 200 spent on nearly all kinds of purchases within the country and other parts of the world except for a few specified categories. This applies to the high spenders who want to get the most of their points or miles earned depending on the purchase they make.

Moreover, the card has impressed the travellers with its travel and rental car insurance. Another benefit witnessed with the card is free to access to domestic airport lounges, which are vital, especially to the regular traveler. Combined with the fuel surcharge waiver and travel insurance, the Axis Bank Privilege Credit Card has some of the significant benefits that may be useful for people who value comfort and safety while travelling.

Table of Contents

- Axis Bank Privilege Credit Card

- Axis Bank Privilege Credit Card Advantages and Disadvantages

- Axis Bank Privilege Credit Card – Top Features

- Axis Bank Privilege Credit Card – Reward Offers

- Welcome Benefits of Axis Bank Privilege Credit Card

- Travel Benefits Available on Axis Bank Privilege Credit Card

- Why Choose Axis Privilege Credit Card?

- Axis Bank Privilege Credit Card: Terms and Conditions

- Eligibility Criteria: Who Can Apply?

- Documentation Needed for Axis Bank Privilege Credit Card

- Application Process for Axis Bank Privilege Credit Card

- FAQs

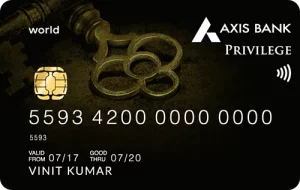

Axis Bank Privilege Credit Card

Joining Fee:

₹ 1,500 + GST

Best Suited :

Travel | Shopping

Renewal Fee:

₹ 1,500 + GST

Reward Type:

Reward Point

Welcome Benefits:

12,500 Edge Reward points on the first transaction post joining fee payment

Axis Bank Privilege Credit Card: Feed and Charges

| Fee Type | Amount |

|---|---|

| Interest Rate: | Up to 3.6% per month (52.86% per annum) |

| Cash Withdrawal Fee: | 2.5% of the withdrawn amount (minimum INR 500) |

| Late Payment Fee: | ➡ INR 300 for statement balance up to INR 2,000 ➡ INR 400 for a statement balance between INR 2,001 and INR 5,000 ➡ INR 600 for a statement balance above INR 5,000 |

| Overlimit Fee: | 3% of the over limit amount (minimum INR 500) |

| Foreign Currency Markup: | 3.5% of the transaction amount |

| Card Replacement Fee: | INR 100 |

Product Details

- 10 Edge Reward points per INR 200 spent domestically, 20 points internationally

- 12,500 Edge Reward points on the first transaction

- Up to 20% savings at over 4,000 partner restaurants

- Complimentary access to select domestic airport lounges

- Personal accident cover up to INR 2.5 lakh, purchase protection up to INR 1 lakh

Rewards and Benefits

- Domestic Spending: Earn 10 Edge Reward points for every INR 200 spent.

- International Spending: Earn 20 Edge Reward points for every INR 200 spent.

- Welcome Bonus: Receive 12,500 Edge Reward points after paying the joining fee and making the first transaction.

- Dining Privileges: Up to 20% savings at over 4,000 partner restaurants across India.

- Fuel Surcharge Waiver: Up to INR 400 per month at all petrol stations across India.

- Travel Benefits: Complimentary access to select domestic airport lounges.

- Insurance Coverage: Personal accident cover of up to INR 2.5 lakh and purchase protection cover of up to INR 1 lakh.

- Renewal Fee Waiver: Spend INR 2.5 lakh annually to waive the INR 1,500 renewal fee.

Axis Bank Privilege Credit Card Advantages and Disadvantages

Advantages

- Reward Points: Earn 10 Edge Reward points for every INR 200 spent domestically and 20 points for international transactions.

- Welcome Benefits: Receive 12,500 Edge Reward points upon paying the joining fee and making the first transaction.

- Dining Discounts: Enjoy up to 20% savings at over 4,000 partner restaurants across India.

- Travel Benefits: Complimentary access to select domestic airport lounges adds comfort during travel.

- Insurance Coverage: Includes personal accident cover up to INR 2.5 lakh and purchase protection up to INR 1 lakh.

Disadvantages

- High Spenders: Benefits are more advantageous for frequent spenders who can maximize rewards and waiver benefits.

- Limited International Benefits: Lounge access and other perks are more tailored towards domestic usage.

- Foreign Transaction Fees: A 3.5% markup on foreign currency transactions adds to costs for international travellers.

Axis Bank Privilege Credit Card – Top Features

#1. Welcome Benefits:

- Earn 12,500 Edge Reward points after paying the joining fee and making the first transaction.

- Immediate value through redeemable points for a variety of products and services.

#2. Milestone Benefits:

- Spend INR 2.5 lakh annually to waive the renewal fee of INR 1,500 + taxes.

- Additional reward points and vouchers are offered for achieving higher annual spending milestones.

#3. Travel Benefits:

- Complimentary access to select domestic airport lounges, enhancing travel comfort.

- Earn 20 Edge Reward points for every INR 200 spent internationally.

#4. Dining Benefits:

- Up to 20% savings at over 4,000 partner restaurants across India.

- Exclusive dining offers and discounts, make eating out more affordable.

#5. Insurance Benefits:

- Personal accident cover of up to INR 2.5 lakh, providing financial security in case of emergencies.

- Purchase protection cover of up to INR 1 lakh, safeguarding high-value transactions against theft or damage.

Axis Bank Privilege Credit Card – Reward Offers

Domestic Spending: Earn 10 Edge Reward points for every INR 200 spent on domestic transactions.

International Spending: Earn 20 Edge Reward points for every INR 200 spent on international transactions.

Welcome Bonus: Receive 12,500 Edge Reward points after paying the joining fee and making the first transaction.

Annual Milestone: Spend INR 2.5 lakh in a year to get the renewal fee of INR 1,500 waived, adding value to high spenders.

Redemption Options: Redeem Edge Reward points for a variety of options, including travel bookings, merchandise, gift vouchers, and more, providing flexibility and choice in using your rewards.

Welcome Benefits of Axis Bank Privilege Credit Card

Upon acquiring the Axis Bank Privilege Credit Card, cardholders are greeted with substantial welcome benefits, enhancing the initial card value significantly:

- Edge Reward Points: Receive a generous welcome bonus of 12,500 Edge Reward points upon payment of the joining fee and completion of the first transaction. These points can be quickly accumulated and redeemed for a variety of rewards including travel bookings, merchandise, and gift vouchers.

- Value Addition: This welcome bonus provides an immediate boost to your rewards balance, allowing you to start enjoying the benefits of the card from the outset.

- Redemption Options: The Edge Reward points can be easily redeemed through Axis Bank’s rewards portal, offering flexibility and convenience in choosing rewards that suit your preferences and lifestyle.

- Financial Advantage: By effectively utilizing the welcome benefits, cardholders can offset the joining fee and initial expenses, maximizing the value derived from the Axis Bank Privilege Credit Card right from the beginning of their card membership.

Travel Benefits Available on Axis Bank Privilege Credit Card

The Axis Bank Privilege Credit Card offers a range of travel benefits aimed at enhancing the travel experience for cardholders:

- Airport Lounge Access: Enjoy complimentary access to select domestic airport lounges across India, providing comfort and relaxation before flights.

- Travel Insurance: Receive comprehensive travel insurance coverage, including personal accident insurance up to INR 2.5 lakh and purchase protection insurance up to INR 1 lakh.

- Fuel Surcharge Waiver: Benefit from a fuel surcharge waiver of up to INR 400 per month at all petrol pumps across India, making travel by car more cost-effective.

- International Travel: Earn 20 Edge Reward points for every INR 200 spent internationally, accumulating rewards faster for travel-related expenses.

- Travel Assistance: Access round-the-clock concierge services for travel-related queries, reservations, and emergencies, ensuring a smooth travel experience.

Why Choose Axis Privilege Credit Card?

- Uncapped Rewards on Most Spends: Unlike many reward cards that focus on specific categories, the Privilege Credit Card offers a flat rate of 10 EDGE points per Rs. 200 on most domestic and international transactions (excluding a few categories). This is ideal if you spend across various categories and want to maximize your overall rewards.

- Travel Perks for Frequent Flyers: This card caters to frequent flyers with complimentary access to domestic airport lounges twice a quarter. Additionally, you get a fuel surcharge waiver on fuel purchases, making road trips more economical. Travel insurance provides peace of mind while you’re on the go.

- Potential for Fee Waiver: The annual fee of Rs. 1500 can be waived off if you spend Rs. 2.5 lakhs or more in a year, making it potentially a good deal for high spenders.

- Comprehensive Insurance Coverage: The card offers a range of insurance benefits, including purchase protection, lost baggage cover, and even a credit shield for financial security.

- Focus on Convenience: Features like automatic fuel surcharge waiver and lounge access add convenience to your lifestyle, especially if you travel frequently.

Axis Bank Privilege Credit Card: Terms and Conditions

- Interest Rate: Up to 3.6% per month (52.86% per annum).

- Cash Withdrawal Fee: 2.5% of the amount (minimum INR 500).

- Late Payment Fee: Ranges from INR 300 to INR 600 based on the outstanding balance.

- Overlimit Fee: 3% of the overlimit amount (minimum INR 500).

- Foreign Currency Markup: 3.5% on international transactions.

- Grace Period: Up to 50 days, subject to the previous month’s balance being paid in full.

- Rewards Redemption: Points can be redeemed via the Axis Bank rewards portal for various options like travel, merchandise, and vouchers.

- Customer Service: 24/7 support is available for card-related queries and assistance.

Eligibility Criteria: Who Can Apply?

To ensure that the Axis Bank Privilege Credit Card aligns with your financial profile, it’s essential to meet specific eligibility criteria. These criteria are set to evaluate the applicant’s creditworthiness and financial stability, ensuring that the benefits of the card are accessible to those who can effectively manage them.

Age Requirements: 18 to 70 years old.

Income Criteria:

- Salaried: Minimum annual income of INR 6,00,000.

- Self-employed: Similar income level through business earnings.

Credit Score: Preferably above 750.

Documentation Needed for Axis Bank Privilege Credit Card

To apply for the Axis Bank Privilege Credit Card, you need to provide specific documents that verify your identity, address, and income. Here are the detailed requirements:

- Proof of Identity:

- Passport

- Aadhaar Card

- Voter ID

- Driving License

- PAN Card

- Proof of Address:

- Utility Bill (Electricity, Water, Gas)

- Rent Agreement

- Passport

- Aadhaar Card

- Driving License

- Proof of Income:

- Salaried Individuals:

- Latest salary slips (last 3 months)

- Bank statements (last 3 months)

- Form 16

- Self-employed Individuals:

- Income Tax Returns (ITR) for the last 2 years

- Bank statements (last 6 months)

- Audited financials (last 2 years)

- Salaried Individuals:

- Photographs:

- Recent passport-sized photographs (usually 2)

Application Process for Axis Bank Privilege Credit Card

- Visit Axis Bank Website: Access Axis Bank’s website, search for the ‘Credit Cards’ tab, and choose the ‘Privilege Credit Card’ link.

- Complete Application Form: Visit the website of Axis Bank and complete the Axis Bank Privilege Credit Card application form accurately providing genuine personal details, contact details, and financial details.

- Submit Required Documents: Once you have formatted the above documents, they can either be uploaded through the online portal once you scan them or one can submit them in physical hard copy to the nearest Axis Bank branch.

- Application Review and Approval: Once you provide the documents and complete the application, Axis Bank will go through a verification process. After confirmation and when the card is approved, the Axis Bank Privilege Credit Card will be delivered to your registered address.

FAQs

Q1. What are the reward points like with this card?

A1. This Axis Bank Privilege Credit Card offers an enriching 10 EDGE reward points on every Rs. 200 spent on majority of the domestic as well as international transactions. But they do not accrue points on transactions such as rent payment, wallet loads etc.

Q2. Are there any annual fee waivers?

A2. The card has an annual fee of Rs. 1500. This fee can be waived if you spend Rs. 2.5 lakhs or more in the previous year excluding rent and wallet transactions.

Q3. Does the card offer any travel benefits?

A3. Yes, the Axis Bank Privilege Credit Card caters to frequent flyers with complimentary access to domestic airport lounges. Additionally, it provides a fuel surcharge waiver on transactions between Rs. 400 and Rs. 4,000 per statement cycle, along with travel insurance for a more secure travel experience.

Q4. What are the eligibility criteria for this card?

A4. To be eligible for the Axis Bank Privilege Credit Card, you must be between 18 and 70 years old, a resident of India, and have a minimum net income of Rs. 6 lakhs annually.

Q5. How do I claim the fuel surcharge waiver benefit?

A5. The fuel surcharge waiver is automatic for transactions between Rs. 400 and Rs. 4,000 made at any fuel station across India. However, keep in mind that service tax on the surcharge is non-refundable and you won’t earn reward points on these fuel transactions.