The novel product of ICICI Bank is the ICICI Bank HPCL Coral Credit Card, which has been launched with the help of a partnership between ICICI Bank and Hindustan Petroleum Corporation Limited (HPCL) to provide immense fuel discounts to consumers. This product was introduced into the market as part of the Coral series associated with ICICI Bank, and the key features include fuel cash back, surcharge waivers on the card, retail spending reward points, etc.

In addition to fuel, it provides movie and dining offers through BookMyShow and the ICICI Bank Culinary Treats Programme, making it relevant for all regular dinners and entertainment lovers. Boasting fuel savings and extra features to improve the quality of the consumer’s life, the ICICI Bank HPCL Coral Credit Card is a versatile financial instrument for daily use.

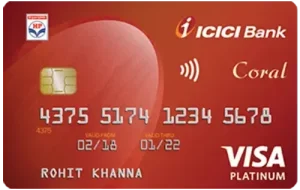

ICICI Bank HPCL Coral Credit Card

Joining Fee:

Rs. 199 + GST

Best Suited :

Fuel | Shopping

Renewal Fee:

Rs. 199 + GST (waived on annual spends of Rs. 50,000)

Reward Type:

Reward Points

Welcome Benefits:

None

ICICI Bank HPCL Coral Credit Card Features and Benefits

1. Fuel Benefits

- 2.5% Cashback on Fuel: Cardholders can enjoy a 2.5% cashback (up to Rs. 100 per transaction) when purchasing fuel worth Rs. 500 or more at authorized HPCL outlets.

- 1% Fuel Surcharge Waiver: The card offers a 1% fuel surcharge waiver on transactions of Rs. 4,000 or more at HPCL petrol pumps, helping to reduce overall fuel costs.

- Note: Fuel purchases do not earn reward points but the fuel cashback and surcharge waiver provide substantial savings.

2. Movie and Dining Benefits

- Movie Discounts: Cardholders get a 25% discount (up to Rs. 100 per transaction) on purchasing a minimum of two movie tickets through BookMyShow. This offer is available twice a month, adding up to a Rs. 200 monthly savings.

- Dining Discounts: You can avail of up to 15% savings at over 800 participating restaurants across India through the ICICI Bank Culinary Treats Programme, offering great value for dining out.

3. Fee Waiver

- Annual Fee Waiver: If you spend Rs. 50,000 or more in a card anniversary year, the renewal fee is waived, allowing you to save further on card costs.

4. Other Features

- EMI Option: Convert large purchases into EMIs, offering flexibility for payments on high-value transactions.

- Contactless Payments: The ICICI Bank HPCL Coral Credit Card supports contactless transactions, enabling quick and secure payments at compatible POS machines.

- Global Acceptance: This card is widely accepted across India and internationally, making it suitable for frequent travelers as well.

How to Earn and Redeem ICICI Bank HPCL Coral Credit Card Reward Points

How to Earn Reward Points

- Retail Purchases: You earn 2 reward points for every Rs. 100 spent on retail purchases using the ICICI Bank HPCL Coral Credit Card. This applies to most categories, including shopping, dining, and other non-fuel transactions.

- Fuel Purchases: Though fuel transactions at HPCL outlets do not earn reward points, you benefit from a 2.5% cashback (up to Rs. 100) and a 1% fuel surcharge waiver for fuel purchases of Rs. 500 and above.

Reward Redemption

- Products and Vouchers: You can redeem your accumulated reward points for a wide variety of products and shopping vouchers through the ICICI Bank Rewards Catalogue available at www.icicibank.com.

- Fuel Redemption: Redeem your reward points directly for fuel. 2,000 reward points can be redeemed for Rs. 500 worth of fuel at HPCL outlets. This provides an additional way to save on fuel purchases.

Reward Point Value

- 1 Reward Point = Rs. 0.25.

- For example, 1,000 reward points are worth Rs. 250, which can be used toward your selected redemptions.

ICICI Bank HPCL Coral Credit Card Fees and Charges

1. Finance Charges: 3.40% per month (or 40.8% annually)

2. Cash Withdrawal Charges (Cash Advance Fee): 2.50% of the amount withdrawn or a minimum of Rs. 300, whichever is higher.

3. Late Payment Charges

- Up to Rs. 100: Nil

- Rs. 101 to Rs. 500: Rs. 100

- Rs. 501 to Rs. 10,000: Rs. 500

- Above Rs. 10,000: Rs. 750

4. Overlimit Charges: 2.50% of the overlimit amount or a minimum of Rs. 300, whichever is higher.

5. Foreign Currency Transaction Fee: 3.5% of the transaction amount for any foreign currency transaction.

6. Cash Payment at Branches: Rs. 100 per payment if you pay your credit card bill in cash at an ICICI Bank branch.

7. Reward Redemption Fee: Rs. 99 + GST per redemption request.

8. Duplicate Statement Fee: Rs. 100 for requests older than 3 months.

ICICI Bank HPCL Coral Credit Card Product Details

- Get 2.5% cashback (up to Rs. 100) on fuel purchases of Rs. 500 and above at HPCL outlets, along with a 1% fuel surcharge waiver for transactions of Rs. 4,000 or more.

- Earn 2 reward points for every Rs. 100 spent on retail purchases (excluding fuel).

- 1 reward point equals Rs. 0.25 and can be redeemed for products, vouchers, or fuel (2,000 points = Rs. 500 fuel).

- Enjoy a 25% discount on BookMyShow (up to Rs. 100), available twice a month with a minimum purchase of two tickets.

- Get up to 15% savings at over 800 restaurants across India through the ICICI Bank Culinary Treats Programme.

- The card supports contactless technology for quick and secure payments at NFC-enabled terminals.

- The card is globally accepted and carries a 3.5% foreign currency markup fee for international transactions.

ICICI Bank HPCL Coral Credit Card Eligibility Criteria

- Age:

- Primary Cardholder: Must be between 23 and 60 years of age.

- Add-on Cardholder: Must be at least 18 years old.

- Employment Status:

- Salaried Individuals: Must have a stable job with a reputable organization.

- Self-employed Individuals: Must show a stable income source and provide business-related documentation.

- Credit Score:

- A good credit score (typically 750 or above) is required to enhance the chances of approval.

Documents Required for ICICI Bank HPCL Coral Credit Card

- Proof of Identity (any one of the following):

- Aadhar Card

- PAN Card

- Passport

- Voter ID

- Driving License

- Proof of Address (any one of the following):

- Aadhar Card

- Passport

- Utility Bill (electricity, water, gas)

- Rent Agreement

- Bank Statement with address details

- Proof of Income:

- For Salaried Individuals:

- Recent salary slips (last 3 months)

- Bank statements (last 3 months) showing salary credit

- Form 16

- For self-employed individuals:

- Income Tax Returns (ITR) for the last 2 years

- Bank statements (last 6 months)

- Business proof (registration certificate, business continuity proof)

- For Salaried Individuals:

- Photographs:

- Recent passport-sized photographs (as per bank requirements).

- PAN Card:

- Mandatory to apply for the credit card.

How to Activate ICICI Bank HPCL Coral Credit Card Online

- Visit www.icicibank.com and log in with your credentials.

- Go to “Cards & Loans” and select “Credit Cards.”

- Select your card and choose the activation option.

- Enter your card details and set a PIN.

- Enter the OTP sent to your registered mobile number.

- Your card is now activated and ready for use.

FAQs

Q1. Is it possible to activate my ICICI HPCL Coral Credit Card through the mobile application?

Ans: Yes, the activation of credit cards through Internet banking is as easy as the iMobile app, in which one has to register in the app and navigate to the card activation option.

Q2. Is it compulsory to choose the PIN at the time when the card is activated online?

Ans: Yes, during the activation, people are obliged to set some PIN since it is obligatory for all transactions and withdrawals with an ATM.

Q3. What should I do if OTP is not received during the activation?

Ans: Make sure that the registered mobile number to the ICICI Bank is correct. If the problem remains, one should approach the customer service of the ICICI bank.

Q4. Can I start using my card right after activation?

Ans: Yes, immediately after activation and the OTP, the card becomes active and may be used at that very time.