Established in November 1994, IndusInd Bank is a well-known private bank in India, with 2,600 branches around the country and its headquarters located in Pune.

The bank provides a broad range of services, such as Treasury Services and Retail, Corporate, and Wholesale Banking.

IndusInd Bank has made significant progress in the credit card market. The bank started offering credit cards in 2011–2012, and recently, it introduced several premium cards with unique features, including the Pioneer Heritage Credit Card and the Indulge Credit Card.

Additionally, they launched the Platinum Card, which is IndusInd Bank’s first RuPay Credit Card. Known for its innovation and customer-centric approach, IndusInd Bank is a trusted financial partner that offers banking and credit card services to meet evolving customer needs.

Table of Contents

- List of Top IndusInd Bank Credit Cards

- 1. IndusInd Bank Legend Credit Card

- 2. IndusInd Bank Platinum RuPay Credit Card

- 3. IndusInd Bank Platinum Credit Card

- 4. Platinum Aura Edge Credit Card from IndusInd Bank

- 5. Platinum Credit Card from EazyDiner Industries

- 6. Credit Card issued by EazyDiner IndusInd Bank

- 7. Club Vistara Explorer Credit Card from IndusInd Bank

- 8. Visa Infinite Avios Credit Card from IndusInd Bank

- 9. Samman RuPay Credit Card from IndusInd Bank

- 10. Credit Card Indus Solitaire

- 11. IndusInd Bank Tiger Credit Card

- 12. IndusInd Bank Pinnacle World Credit Card

- IndusInd Bank Credit Cards Benefits and Features

- IndusInd Bank Credit Card Rewards and Cashback

- How To Earn and Redeem IndusInd Bank Credit Card Reward Points?

- IndusInd Bank Credit Card Eligibility Criteria & Required Documents

- IndusInd Bank Credit Card Annual Fees and Charges

- Apply Online for Indusind bank credit card

- How To Activate IndusInd Bank Credit Cards?

List of Top IndusInd Bank Credit Cards

1. IndusInd Bank Legend Credit Card

The IndusInd Legend Credit Card is perfect for frequent flyers. It offers a financially sensible option for individuals who enjoy exploring, as there are no joining or renewal costs. Cardholders can enjoy exclusive benefits like concierge services, travel insurance, and lounge access. Plus, the card offers high travel point benefits to users.

Joining Fee:

Nil

Best Suited For:

Travel

Renewal Fee:

Nil

Reward Type:

Reward Points

Welcome Benefits:

N/A

Key Features

- 1 reward point for every Rs. 100 spent on weekdays

- 2 reward points for every Rs. 100 spent on weekends

- 4000 bonus reward points on spending Rs. 6 lacs or more in a year

- Benefit of Discounted Foreign Currency Mark up at 1.8% on foreign currency transactions done on your Primary & Add-on card

- Fuel surcharge waiver

*Terms and Conditions apply.

2. IndusInd Bank Platinum RuPay Credit Card

The IndusInd Bank Platinum RuPay Credit Card is designed for frequent shoppers. It provides a smooth and rewarding purchasing experience with no joining or renewal fees. Cardholders can enjoy exclusive discounts, cashback incentives, and reward points on their purchases. It’s the ideal choice for individuals who love to shop.

Joining Fee:

Nil

Best Suited For:

Shopping

Renewal Fee:

Nil

Reward Type:

Reward Points

Welcome Benefits:

N/A

Key Features

- 1.5 reward points for every Rs. 150 spent, except fuel spends

- 1 RP = Re. 0.40 against cash credit redemption

- 1 RP = Re. 0.60 for non-cash redemption, except for airmiles

- 100 RP = 100 Air Miles/ CV Points

- Redemption against IndusMoments rewards catalogue and Pay with rewards

*Terms and Conditions apply.

3. IndusInd Bank Platinum Credit Card

If you’re someone who enjoys shopping, the IndusInd Bank Platinum Credit Card is a great option. It comes with a number of advantages and perks, including discounts and cashback offers. And the best part? There are no joining or renewal fees! With every transaction, you can accrue reward points that can be exchanged for interesting presents and gift cards.

Joining Fee:

Nil

Best Suited For:

Shopping

Renewal Fee:

Nil

Reward Type:

Reward Points

Welcome Benefits:

N/A

Key Features

- You earn 1.5 reward points on every ₹150 you spend.

- You can earn 1.2 reward points on every ₹150 spent on select merchant categories like utility bill payments, insurance premium payments, etc. on this card.

- No Reward points will be earned on transactions done towards fuel purchases.

*Terms and Conditions apply.

4. Platinum Aura Edge Credit Card from IndusInd Bank

The IndusInd Bank Platinum Aura Edge Credit Card is perfect for regular shoppers. It is reasonably priced and comes with special benefits because there are no joining or renewal costs. Cardholders’ purchasing experiences are improved by the discounts and cashback opportunities available from a variety of partner brands. Every transaction with the card also earns reward points that can be exchanged for interesting gift cards and vouchers.

Joining Fee:

Nil

Best Suited For:

Shopping

Renewal Fee:

Nil

Reward Type:

Reward Points

Welcome Benefits:

Discount gift vouchers from Pantaloons, Bata, Raymond, Hush Puppies, and more.

Key Features

- You get a 1% fuel surcharge waiver at all fuel stations for all transactions between Rs. 400 & Rs. 4,000.

*Terms and Conditions apply.

5. Platinum Credit Card from EazyDiner Industries

Foodies will love the EazyDiner IndusInd Platinum Credit Card, which offers a variety of eating privileges and rewards. It provides exclusive benefits and affordability with no joining fees and a small renewal charge. Cardholders receive additional EazyPoints upon signup and a free membership to EazyDiner Prime. The card also gives reward points on dining transactions.

Joining Fee:

₹ 500 + GST

Best Suited For:

Food

Renewal Fee:

₹ 500 + GST

Reward Type:

Reward Points

Welcome Benefits:

3-Month EazyDiner Prime Membership and 500 Bonus EazyPoints

Key Features

- 2 reward points on every Rs. 100 spent, except on fuel, insurance, rent, utility and government

- 0.7 reward points on insurance, rent, utility and government spends

- 2X EazyPoints on all spends

- 3 months EazyDiner Prime membership worth Rs. 1,095

- 25% to 50% discount at premium restaurants and bars

- 500 EazyPoints as welcome bonus

*Terms and Conditions apply.

6. Credit Card issued by EazyDiner IndusInd Bank

The EazyDiner IndusInd Bank Credit Card is designed for people who love dining out. It is affordable and comes with rewarding points and nice welcome perks. Cardholders receive additional reward points upon signup and are granted access to EazyDiner Prime. To improve the dining experience, the card also offers exclusive discounts and deals at participating restaurants.

Joining Fee:

₹ 1999

Best Suited:

Food

Renewal Fee:

₹ 1999

Reward Type:

Reward Points

Welcome Benefits:

2,000 bonus RPs and complimentary membership of EazyDiner Prime.

Key Features

- 10 reward points per Rs. 100 spent on shopping, dining and entertainment

- 4 reward points per Rs. 100 spent across all other categories except fuel

- 3X EazyPoints on all spends

- Complimentary 12-month EazyDiner Prime Membership worth Rs. 2,495

- 25% to 50% discount at premium restaurants and bars

- 2,000 EazyPoints as welcome bonus

- Postcard Hotel stay voucher worth Rs. 5,000

*Terms and Conditions apply.

7. Club Vistara Explorer Credit Card from IndusInd Bank

Aiming at regular travellers, the Club Vistara IndusInd Bank Explorer Credit Card brings a palette of delightful travel-related advantages and bonuses. Participants will count on the Club Vistara Gold Membership that takes care of the VIP experience on board. Furthermore, travellers receive additional benefits such as cheaper flights and lower hotel bookings have been added in this concept. The reward points will be credited to the transactions. These points can then be used for upgrading the air tickets and hotel stays. There are also more customisation options available for those customers who give travel top priority.

Joining Fee:

₹ 40000

Best Suited:

Movies

Renewal Fee:

₹ 10000

Reward Type:

Reward Points

Welcome Benefits:

Complimentary Club Vistara Gold Membership, complimentary business class ticket, and exclusive gift vouchers worth Rs 25,000

Key Features

- You get 1 reward point for every Rs.200 that you spend on insurance, government payments, utility, and fuel.

- You get discount vouchers from Louis Philippe, Charles and Keith, Urban Ladder, and Hush Puppies.

- You get up to 2 free movie tickets per month.

- You get 8 reward points for every Rs.200 that you spend on Vistara website/app.

*Terms and Conditions apply.

8. Visa Infinite Avios Credit Card from IndusInd Bank

It is the card for travelers who aim to live in luxury in particular. The financial specialists from IndusInd Bank have done their best to offer the best conditions and activities. In addition to this, the card comes with gold status, which is free for the customer and a higher number of Avios points for a successful registration. But not the least, are selected among the several other offered benefits as very exclusive and privileged. Moreover, with the card, swiping for purchases accumulates a large number of reward points that can be employed to reserve a trip, find accommodation, or try something new.

Joining Fee:

₹ 40000

Best Suited:

Travel

Renewal Fee:

₹ 10000

Reward Type:

Reward Points

Welcome Benefits:

Complimentary Gold tier membership and bonus 20,000 Avios for Qatar Airways Privilege Club members, and bonus 55,000 Avios for British Airways Executive Club members.

Key Features

- 25,000 bonus Avios after your first spend of Rs. 8 lakh in a year

- 25,000 bonus Avios after your second spend of Rs. 8 lakh in a year

- 5 Avios for every Rs. 200 spent at select preferred international destinations for PoS transactions. Click here for the list of eligible destinations.

- 2 Avios for every Rs. 200 spent on Qatar Airways & British Airways website and app*

- 10% discount on flight bookings through Qatar Airways website or mobile app, on choosing Qatar Airways Privilege Club as the preferred airline loyalty programme

- 10% additional discount for Privilege Club members on all flights originating from India, if booked via Qatar Airways platforms

- Complimentary Priority Pass membership with 2 international lounge visits per calendar quarter

- 2 complimentary visits per calendar quarter in any of the participating domestic lounges

- Low forex markup fee of 1.5%

- Travel Insurance Benefits of Lost Baggage: Rs. 1 Lakh, Delayed Baggage: Rs. 25,000, Loss of Passport: Rs. 50,000, Loss of Ticket: Rs. 25,000 and Missed Flight Connection: Rs. 25,000

- 2 complimentary meet-and-greet services per year at leading international airports for smooth check-in, security, immigration and much more

*Terms and Conditions apply.

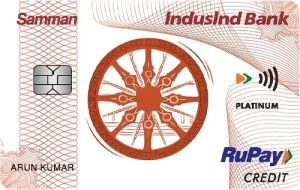

9. Samman RuPay Credit Card from IndusInd Bank

The IndusInd Bank Samman RuPay Credit Card is for individuals who are looking for convenience and affordability. These include essential, although not very generous, provisions, wherein no admission fees need not be paid, and no annual charges are also quite nominal. At the same time, the consumers are given an advantage of cashback incentives on their regular purchases. This scheme also includes features such as different payment modes to provide financial protection as well as insurance coverage. They also offer 100 top-tier points of protection to their customers so that they can save on insurance premiums.

Samman RuPay Credit Card

Joining Fee:

₹ Nil

Best Suited:

Shopping

Renewal Fee:

₹ 199

Reward Type:

Reward Points

Welcome Benefits:

N/A

Key Features

- Get 1% cashback on all Retail spends in every statement cycle. Total Retail Spends of upto ₹ 20,000 will be eligible for cashback in a statement cycle.

- Get one assured movie ticket upto ₹ 200/- every 6 months in a calendar year via BookMyShow

- Waiver of 1% Waiver on Fuel Surcharge

- 1% Waiver on Railway Surcharge on Transactions up to ₹ 5,000

- Nil Cash Advance fee

*Terms and Conditions apply.

10. Credit Card Indus Solitaire

Solitaire Indus Credit Card is for people who are into luxury. They can feel special with their friends with the best features and one of the amazing rewards from this card. Aside from enjoying the most benefit from any transaction they make, cardholders get the chance of access to some really famous and elite rewards programs such as Taj Epicure, EazyDiner Prime, and Moneycontrol Pro.

It has always been the first choice for millions because of the orientation it has to luxury and the desire it shows for individualised attention.

Credit Card Indus Solitaire

Joining Fee:

₹ 30000

Best Suited:

Travel

Renewal Fee:

₹ 10000

Reward Type:

Reward Points

Welcome Benefits:

Free Taj Epicure, EazyDiner Prime, and Moneycontrol Pro Membership. 5,000 Reward Points on Spending Rs. 1 Lakh Within 30 Days of Card Issuance.

Key Features

- Zero Foreign Currency Mark-up on all international spends

- Taj Epicure Preferred Membership

- 16 International and 16 Domestic lounge visits in a year

- International Travel Health Insurance of USD 25,000

- EazyDiner Prime Membership

- Extraordinary concierge

*Terms and Conditions apply.

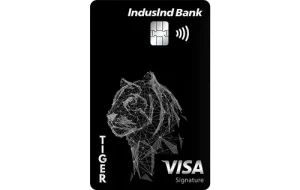

11. IndusInd Bank Tiger Credit Card

The IndusInd Bank Tiger Credit Card provides numerous benefits for those seeking a low-investment credit card. With zero annual fees, it is an affordable choice for users. Additionally, this card allows you to earn up to 6X rewards on your spending.

Joining Fee:

Free

Best Suited:

Online and offline shopping

Renewal Fee:

Free

Reward Type:

Reward Points

Welcome Benefits:

The card does not offer any form of welcome benefit to its customers but comes with cashback and rewards.

Key Features

- Earn reward points with every transaction.

- Each reward point equals INR 0.40.

- Convert 1 RP to INR 1.2 air miles.

- Redeem air miles for travel perks such as free flights, ticket upgrades, and other

- Ideal for domestic travelers with 8 free lounge accesses per year.

- Enjoy free international airport lounge access twice a year via the Priority Pass Program.

- Earn up to 6X reward points on transactions of INR 100 and above.

- Four complimentary golf lessons annually for game enthusiasts.

- Receive a 1% fuel surcharge waiver on spending between INR 400 and 4,000 at fuel stations in India.

- Access discounted movie tickets through BookMyShow.

- Enjoy a complimentary priority pass membership with the Tiger credit card.

*Terms and Conditions apply.

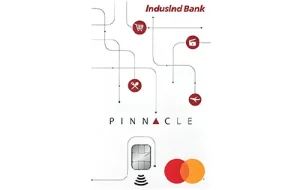

12. IndusInd Bank Pinnacle World Credit Card

Experience luxury with the IndusInd Bank Pinnacle World Credit Card. Enjoy free access to 1,200+ airport lounges, earn 2.5 reward points per Rs. 100 on online spends, and 1.5 points per Rs. 100 on travel. Ideal for those who value sophistication and rewards.

Joining Fee:

₹ 14,999 + GST

Best Suited:

Travel | Shopping | Lifestyle

Renewal Fee:

Free

Reward Type:

Reward Points

Welcome Benefits:

The card does not offer any form of welcome benefit to its customers but comes with cashback and rewards.

Key Features

- Renewal Fee: None

- Finance Charges: 3.83% per month (46% annually)

- Cash Advance Fee: 2.5% of the transaction (min. Rs. 300)

- Foreign Currency Markup: 3.5% of the transaction

- Over-limit Fee: 2.5% of over-limit amount (min. Rs. 500)

- Welcome Gift: Luxe gift card, Oberoi hotel stay, or brand vouchers

- Travel E-commerce: 1.5 reward points per Rs. 100 spent

- Redemption: 1 RP = Re. 1 (cash) or 1 RP = 1 InterMile/Club Vistara Point (travel)

- BookMyShow Offer: Buy 1 Get 1 Free (up to 3 tickets/month)

- Lounge Access: 1 domestic and 2 international visits per quarter

*Terms and Conditions apply.

IndusInd Bank Credit Cards Benefits and Features

Credit cards from IndusInd Bank provide a range of exclusive benefits and features that are customised to fit your needs. Now let’s explore a few of these fascinating advantages:

1. Welcome Benefits: Upon your registration for an IndusInd Bank credit card, a range of rewarding starting benefits awaits you. Things like free movie tickets, Bonus Reward Points, gift cards, and even access to premium memberships of different special platforms are some of the examples of these.

2. Reward/Cashback: Once you have the credit card, provided by the bank, you are entitled to receive different offers like cashback and points as well from your IndusInd Bank credit card each time you swipe it. The best thing about these is that you have the possibility to use the points in multiple ways; you could convert them into anything from flight discounts to store credit for shopping.

3. Entertainment and Dining Delights: The top credit cardholders of IndusInd credit cards are allowed to take advantage of different movies and dining cultures due to the features that accompany the rewards. Get free movie tickets, offers at luxury restaurants, and other thrilling savings that entertain you at all times.

4. Travel Benefits: If you are a frequent flyer or a vacation enthusiast, then you are in luck because IndusInd Bank offers a set of travel benefits that are second to none. You may choose from an array of travel offers starting from complimentary access to airport lounges and discounts on hotel and ticket reservations. Few cards even grant free memberships with the finest hotels and most important airline companies.

5. Extra Benefits: On top of what is mentioned above, some IndusInd credit cards offer a laundry list of additional non-mentioned perks as they aim to make their clients’ lives easier. These could include benefits that waive the cost of fuel, insurance policies, golf outings, and more. Your IndusInd Bank credit card will no longer feel like the means to make payments issued by the bank but a passport to a smooth sailing life and luxury.

IndusInd Bank Credit Card Rewards and Cashback

You can earn benefits with IndusInd Credit Cards in the form of cashback, InterMiles, reward points, or other rewards. Depending on the card and spending category, different rewards and incentives apply. The top Indian credit cards’ reward rates are compared here:

| 1. IndusInd Bank Indulge Credit Card: | For every Rs. 100 spent, earn 1.5 Reward Points. |

| 2. IndusInd Bank Crest Credit Card: | Earn 2.5 reward points for every Rs. 100 spent on foreign purchases and 1 reward point for every Rs. 100 spent on domestic transactions. |

| 3. IndusInd Bank Pioneer Heritage Credit Card: | Earn 2.5 reward points for every Rs. 100 spent on foreign purchases and 1 reward point for every Rs. 100 spent on local transactions. |

| 4. IndusInd Bank Pinnacle Credit Card: | Earn 2.5 reward points for every Rs. 100 spent online and 1.5 reward points for every Rs. 100 spent on online travel and flight reservations. |

| 5. IndusInd Bank Legend Credit Card: | Earn 1 reward point for every Rs. 100 spent on weekdays and 2 reward points for every Rs. 100 spent on weekends. |

| 6. IndusInd Bank Duo Credit Card: | For every Rs. 150 spent, earn one reward point. |

| 7. IndusInd InterMiles Voyage Visa Credit Card: | Earn 4 InterMiles for every Rs. 100 spent on travel and hotel reservations and 2 InterMiles for every Rs. 100 spent on other categories on weekdays. |

| 8. IndusInd Bank Platinum Select Credit Card: | For every Rs. 150 spent, earn one reward point. |

| 9. IndusInd Bank Platinum Aura Credit Card: | Earn 0.5 Saving Points for every Rs. 100 spent on all categories and 4 Saving Points for every Rs. 100 spent on certain categories. |

How To Earn and Redeem IndusInd Bank Credit Card Reward Points?

Users of credit cards issued by IndusInd Bank can utilise the IndusMoments portal to redeem their reward points. To accomplish this, choose the vouchers you wish to use and finish the transaction by entering your credit card information.

Every transaction made with an IndusInd Bank credit card earns you reward points, and the greatest part is that these points never expire. As long as you own the card, you can do this to accrue and redeem them whenever it is convenient for you.

How to redeem the Reward Points on Your IndusInd Credit Card:

- Step 1: Go to www.indusmoments.com to access the IndusMoments site.

- Step 2: Decide on the kind of credit card.

- Step 3: Enter your registered cellphone number and the last four numbers of your card to log in.

- Step 4: In the menu bar, select “redeem” to peruse the different service categories.

- Step 5: Fill the cart with the merchandise and coupons you’ve selected.

- Step 6: Continue with “checkout.”

- Step 7: To finish the purchase, enter your credit card information

IndusInd Bank Credit Card Eligibility Criteria & Required Documents

IndusInd Bank has set clear eligibility criteria for issuing credit cards to applicants:

- Applicants must be aged between 21 and 75 years.

- Applicants must be a citizen of India to apply.

- Non-ICICI Bank Salaried customers: ₹3,60,000

- They must be either self-employed or salaried employees.

- A stable income source is required. A minimum income of INR 20,000 per month is necessary.

- You need to have a good CIBIL score.

Documents Required:

When applying for an IndusInd Credit Card, have the following documents ready. If applying online, keep scanned copies available:

| Identity Proof | Address Proof |

|---|---|

| Aadhaar Card | Aadhaar Card |

| Driving License | Passport |

| Voter’s ID | Utility Bills (not more than 3 months old) |

| PAN Card | Any other government-approved ID |

| Passport | – |

| Any other government-approved ID | – |

Income Proof (any one):

- Bank Statement or salary slip from the last 3 months

- Last 2 years’ audited financial report

IndusInd Bank Credit Card Annual Fees and Charges

There is a joining fee that IndusInd Bank customers must pay in order to activate their credit card. In order to keep the card active after the second year, there is usually an annual or renewal cost. These fees have different amounts based on the type of card. Certain credit cards waive fees upon reaching a predetermined spending threshold. The yearly and joining fees for a few well-known IndusInd credit cards are listed below:

| Credit Card | Joining Fee | Annual Fee |

|---|---|---|

| IndusInd Legend Credit Card | Rs. 9,999 | Nil |

| IndusInd Bank Platinum Credit Card | Rs. 3,000 | Nil |

| IndusInd Bank Platinum Aura Edge Credit Card | Rs. 500 | Nil |

| EazyDiner IndusInd Credit Card | Rs. 1,999 | Rs. 1,999 |

| InterMiles IndusInd Odyssey Credit Card | Rs. 10,000 | Nil |

| IndusInd Bank Nexxt Credit Card | Rs. 10,000 | Rs. 4,000 |

Other Fees & Charges

Here are the fees for various services related to IndusInd Bank credit cards:

| Add-on Card Fee: | Nil |

| Returned Cheque Fee: | Rs. 250 |

| Balance Enquiry Charges on Other Bank ATMs: | Rs. 25 |

| Card Replacement Fee: | Rs. 100 |

| Cash Payment at IndusInd Bank Branch: | Rs. 100 |

| Rewards Redemption Fee: | Rs. 100 |

| Duplicate Physical Statement Request: | Rs. 100 per statement beyond the last 3 months. |

Apply Online for Indusind bank credit card

Applying for an IndusInd Bank credit card online is straightforward. Here’s how you can do it:

- Visit the IndusInd Bank Website: Go to the IndusInd Bank website and find the credit card section.

- Check Your Eligibility:Enter your mobile number and PAN to see if you qualify for a credit card.

- Choose Your Card: Select the credit card that best suits your needs from the available options.

- Fill Out the Application Form: Complete the form with your personal and financial details.

- Complete Video KYC: Finish the application by verifying your identity through a video KYC process.

- Receive Your Card: Once approved, your credit card will be sent to you within a few days.

This easy process allows you to apply for a credit card from the comfort of your home.

How To Activate IndusInd Bank Credit Cards?

The procedures to activate your IndusInd credit card through different means are as follows:

1. Activation Page:

- Check Out the Service Page: Proceed to the credit card service page of the bank.

- Enter Card Details: Enter your registered cellphone number and the last four digits of your card number.

- Enter OTP: Type the OTP that was sent to your registered cellphone number.

- Set Up PIN and Enable Transactions: Configure your PIN and allow online transactions with your card.

2. SMS-based activation:

- Allow Domestic Online Transactions: From your registered cell number, send the SMS “ACTE” to 5676757. Your IndusInd Credit Card can now be used domestically online due to this feature.

- Enable International Transactions: Send an SMS from your registered mobile number to 5676757 with the message “ACTI.” This will allow your IndusInd Credit Card to be used online internationally.

3. Using the IndusMobile App to Activate:

For Clients Already in Bank:

- Login: Launch the IndusMobile application and grant access.

- Link Your Card: Select Cards -> Credit Card -> Click Here to Link Immediately.

- Input Credit Card Information: – Give your credit card information.

- Verify using OTP: – Enter the code that was delivered to the mobile number you registered.

New Users:

- Open the App: Save and launch the IndusMobile application.

- Input Cell Phone Number: Provide your cell phone number

- Click on ‘I’m new at Bank’: Select Credit Card after choosing “Do not have a User ID.”

- Enter Card Details: Enter the information for your credit card.

- Verify with OTP: Type the code that was delivered to the mobile number you registered.

How To Contact IndusInd Credit Card Customer Care Assistance?

Call customer service at IndusInd Bank at 1860 267 7777 and ask for help from bank officials to activate your credit card.

Visit a Branch

Alternatively, to finish your credit card activation, go to the closest IndusInd branch and ask bank employees for help if you run into any problems with the aforementioned techniques. You will be able to make use of your IndusInd credit card’s benefits quickly with these adaptable activation choices.

IndusInd Bank Credit Cards Login/Net Banking

Log in with an IndusInd Bank Credit Card:

Here are the steps to log in to your IndusInd Bank credit card account through internet banking:

- Visit the Website: Go to the IndusInd Bank’s official website.

- Click Login: Click the ‘Login’ button located at the top right corner of the screen.

- Enter Credentials: Input your username and password to access your account summary.

Netbanking with an IndusInd Bank Credit Card:

Users need to follow these steps:

- Login : Enter your username and password to access your account via the IndusInd Bank online banking website.

- Go to Service Request :Choose ‘Service Request’ from the menu, then select ‘Indus Net Request’.

- Link Your Credit Card : Press the ‘Link your Credit Card’ button.

- Enter Card Details : Provide your IndusInd Bank credit card information, such as the date of birth, CVV number, and expiration date, as stated on the credit card. Add the card now.

How To Compare IndusInd Bank Credit Cards & Choose The Best One?

It’s wise to consider the following factors while comparing and searching for the best IndusInd Bank credit card for you:

1. Determine what a credit card is necessary for: Consider your lifestyle, your spending patterns, and whether you enjoy travelling. This is going to help you focus on your alternatives

2. Examine the costs associated with every card: Examine fees for joining, yearly, and foreign transactions, among other things. This aids in your comprehension of the card’s price.

3. Examine the benefits each card provides: Weigh all your options for using the points or money you can accrue. This aids in determining if the benefits align with your preferred means of making purchases.

4.Consider the extra benefits and sign-up bonuses that each credit card provides: These could include free memberships, prize points, or coupons. It is wise to compare the benefits as they may vary based on the card.

Conclusion

To sum up, IndusInd Bank Credit Cards come with a ton of features and benefits that are designed to meet a variety of lifestyle requirements. These credit cards accommodate a range of interests, from travel benefits and dining privileges to special rewards and cashback offerings

The procedure of obtaining and managing an IndusInd credit card is simple and effective, with the help of hassle-free online application processes and user-friendly tracking and activation methods. IndusInd Bank offers a card to suit your needs, whether you’re trying to improve your vacation experiences, treat yourself to fine dining, or make daily transactions easier. Apply online for an IndusInd Bank credit card now to access a world of benefits and convenience.

Important Links

Airport Lounge

Add-On Cards

Forex Charges

RuPay Cards

FAQs on Induslnd Bank Credit Card

Q1. What advantages come with credit cards from IndusInd Bank?

A1. Rewards points, cashback, and travel benefits like free lounge access, restaurant discounts, and exemptions of fuel surcharges are all available with IndusInd Bank Credit Cards. Reach spending goals to receive extra incentives.

Q2. How can I apply online for a credit card from IndusInd Bank?

A2. Visit the IndusInd Bank website, select your card, complete the online application, and upload the required files to apply online. After processing your application, the bank will let you know how it’s doing.

Q3. What benefits are available with IndusInd Bank credit cards?

A3. High credit limit, contactless payments, EMI conversion, international acceptance, insurance coverage, and email and SMS alert customisation are among the features.

Q4. How can I get EMIs on my credit card transactions with an IndusInd Bank?

A4. Within a certain time frame, you can use the mobile app, NetBanking, or customer service to convert qualifying purchases into EMIs.

Q5. Is it possible to temporarily block my IndusInd Bank credit card?

A5. IndusInd Bank’s mobile app and NetBanking allow you to temporarily restrict your card without permanently deactivating it.

Q6. How can I make my IndusInd Bank credit card usable abroad?

A6. By changing the settings in your IndusInd Bank mobile app or via NetBanking, you can allow foreign usage.

Q7. Can I update the PIN on my IndusInd Bank credit card online?

A7. Yes, you can quickly and conveniently update your credit card PIN via NetBanking or the IndusInd Bank mobile app.

Q8. Do credit cardholders at IndusInd Bank get any exclusive benefits?

A8. Indeed, IndusInd Bank grants special benefits such as free lounge access, restaurant discounts, and reward points on particular credit cards.

Q9. Is it possible to link my IndusInd Bank credit card to electronic wallets such as Apple Pay or Google Pay?

A9. Yes, you can make easy payments and transactions by connecting your IndusInd Bank credit card to digital wallets like Apple Pay or Google Pay.

Q10. How can I check the amount of reward points on my IndusInd Bank credit card?

A10. By signing into NetBanking or the IndusInd Bank mobile app, you may check the balance of your reward points and exchange them for different incentives.