If you are looking for a credit card that provides you various rewards and offers in terms of traveling expenses, insurance covers, fuel waivers, and so much more, you are in the right place today. We are talking of the one and only PNB RuPay Select Credit Card that is one of the best credit cards available in the market as this credit card knows how to satisfy its card holders with the help of various rewards and offers. Let us look in detail about the PNB RuPay Select Credit Card and see what benefits it provides its customers.

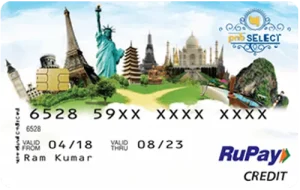

PNB RuPay Select Credit Card

Joining Fee:

₹ 500 + GST

Best Suited :

Shopping

Renewal Fee:

₹ 500 + GST

Reward Type:

Reward Point

Welcome Benefits:

300 points as reward points.

Fees and Charges

Spend-Based Waiver: If you use your PNB RuPay Select Credit Card at least one time every three months, you don’t have to pay the Rs. 750 yearly fee!

- Rewards Redemption Fee: There’s no fee when you use your rewards.

- Foreign Currency Markup: If you buy stuff in another country with the PNB RuPay Select Credit Card, you have to pay 3.5% extra.

- Interest Rates: The interest rate is 2.95% each month.

- Fuel Surcharge: When you buy fuel and spend between Rs. 500 and Rs. 3,000, you get a 1% discount on the extra charge.

- Cash Advance Charges: If you take out cash with the PNB RuPay Select Credit Card, they charge 2% of the amount you take out, but there’s a minimum fee you have to pay.

PNB RuPay Select Credit Card Details

- Welcome Benefit: When you get the PNB RuPay Select Credit Card, you get 300 bonus reward points as a welcome gift.

- Earning Rewards: You get 2 reward points for every Rs. 150 you spend.

- Double Rewards: For the first 90 days, you get double reward points on all stuff you buy online or in stores.

- Bonus for e-Bill: If you sign up for e-bills, you get 50 bonus reward points!

- Airport Lounge: You can chill in the airport lounge for free.

- Free Insurance: You also get free insurance worth Rs. 10 lakhs.

- Fee Waiver: If you spend enough, you don’t have to pay the yearly membership fee.

- Fuel Surcharge: You get a 1% discount on the extra charge when you buy fuel.

Advantages and Disadvantages of PNB RuPay Select Credit Card

Advantages:

- Movie & Dining: You get special cashback when you eat at certain restaurants with the PNB RuPay Select Credit Card.

- Rewards Rate: For every Rs. 150 you spend, you get 2 reward points.

- Reward Redemption: 1 reward point is worth Re. 0.5 when you use it to get cool stuff on the PNB Rewardz portal.

- Travel: You get to use airport lounges for free.

- Domestic Lounge Access: Every three months, you can use domestic airport lounges twice for free.

- International Lounge Access: You can use international airport lounges four times for free.

- Insurance Benefits: You get free insurance worth Rs. 10 lakhs if something happens to you in an accident.

Disadvantages:

- Golf Benefits: Unfortunately, this card doesn’t offer any special perks or discounts for playing golf.

Benefits of PNB RuPay Select Credit Card

- Welcome Benefits: You get 300 bonus reward points when you make your first purchase within 90 days after getting your PNB RuPay Select Credit Card. You also earn 2x reward points on all online or merchandise purchases in the first 90 days after you activate the card.

- Airport Lounge Access: You get 2 free visits to domestic lounges every three months with the PNB RuPay Select Credit Card. Plus, you get 4 free visits to international airport lounges with the same card.

- Insurance Benefits: You get insurance worth Rs. 10 lakhs in case of accidental death or total personal disability.

- Spend-Based Waiver: The Rs. 750 annual fee is waived for the next year if you use your PNB RuPay Select Credit Card at least once every three months in the previous year.

- Fuel Surcharge Waiver: You get a 1% discount on the fuel surcharge for transactions between Rs. 500 and Rs. 3,000. The most you can save on the fuel surcharge is Rs. 250 per billing cycle with this credit card.

Reward Offers of PNB RuPay Select Credit Card

- Shopping Points: You get 2 reward points for every Rs. 150 you spend when you shop.

- Points Expiry: The reward points are only good for three years after you get them.

Rewards Redemption on PNB RuPay Select Credit Card

- Redeeming Points: Log in to the PNB Rewardz portal to use your reward points.

- Value of Points: Each point is worth Re. 0.50 for buying stuff, booking hotels, or recharging your mobile/DTH.

- Minimum Points: You need at least 500 reward points before you can start using them.

Eligibility Criteria of PNB RuPay Select Credit Card

- For Cardholders: You have to be between 21 and 65 years old.

- Adding Others: If you want to add someone to your card, they need to be between 18 and 65 years old.

- Job Requirement: You need to have a steady job or regular money coming in.

Documents Required for PNB RuPay Select Credit Card

- Government ID: You need any ID from the government that says who you are and where you live.

- PAN Card Copy: Bring a copy of your PAN Card.

- Photo: Give a small photo of yourself.

- For People with Jobs: Show the last 3 months of salary slips to prove your income.

- For Self-Employed: Show the latest Income Tax Return (ITR).

Application Process for PNB RuPay Select Credit Card

- Go to the Bank: Visit your nearest Punjab National Bank branch with all the needed documents. Get the physical application form from the bank people, fill it out, and then hand in the form and documents at the branch.

- Online Option: You can also download the form from the PNB Card’s official website. Print it out, fill in all the details, and then go to your nearest branch to submit the form with all the required documents.

FAQs

Q1. What is the PNB RuPay Select Credit Card good for?

Ans: The card gives you rewards and offers for things like traveling, shopping, and even discounts on fuel.

Q2. How much does it cost to get the card and keep it each year?

Ans: You need to pay Rs. 500 + GST to get the card and Rs. 750 + GST each year to keep it.

Q3. How do you earn reward points with this card?

Ans: You get 2 reward points for every Rs. 150 you spend when you shop.

Q4. What can you do with the reward points?

Ans: You can use them to buy things, book hotels, or recharge your mobile/DTH. Each point is worth Re. 0.50.

Q5. What do you need to apply for this card?

Ans: You need a government ID, a copy of your PAN Card, a small photo of yourself, and proof of income like salary slips or Income Tax Return.