Life Insurance Corporation (LIC) is a public sector government-based life insurance company in India. It has its headquarters based in Mumbai, Maharashtra. It is the nation’s largest insurance company and is the largest institutional investor. LIC started its credit card services in 2008.

LIC offers a wide range of credit card benefits and cashback offers. LIC offers credit cards only to those who are the policyholders and insurance agents of the company. To avail of a credit card from LIC, individuals need to apply for a policy. To know more about how to apply for a credit card from LIC and use it without paying any joining and annual fees, check out below.

Table of Contents

- List of Top 7 LIC Credit Cards

- 1. LIC Classic Credit Card

- 2. LIC Select Credit Card

- 3. LIC Eclat Card by IDBI

- 4. LIC Lumine Card by IDBI

- 5. LIC Signature Credit Card

- 6. LIC Platinum Credit Card

- 7. LIC Gold EMV Credit Card

- LIC Credit Card Features and Benefits

- LIC Credit Card Rewards and Cashback

- How To Earn and Redeem LIC Credit Card Reward Points?

- LIC Credit Card Eligibility Criteria

- LIC Credit Card Annual fees

- How to Apply for LIC Credit Cards

- How To Activate LIC Credit Cards?

- LIC Credit Cards Login/Net banking

- How to Check LIC Credit Cards Status

- Bill Payments on LIC Credit Cards

- How To Compare LIC Credit Cards and Choose The Best One?

- LIC Credit Card Customer Care

- Conclusion

- FAQs

List of Top 7 LIC Credit Cards

1. LIC Classic Credit Card

LIC Classic credit card offers premium provides you with rewards on daily purchases and LIC premium payments. These rewards can be redeemed anywhere online such as to pay the upcoming LIC premium. Moreover, one can even have lifestyle privileges, including airport lounge facilities, railway lounge facilities and more.

LIC Classic Credit Card

Joining Fee:

NIL

Best Suited For:

Shopping

Renewal Fee:

NIL

Reward Type:

Reward Points

Welcome Benefits:

The card offers 1,000 reward points for spending INR 5,000 within the first month of the card issue.

Key Features

- 1,000 Rewards on spending Rs. 5,000 within 30 days of card issuance.

- 6 months PharmEasy Plus Membership worth Rs. 399.

- Free 1-year Lenskart Gold Membership worth Rs. 500.

- 5% cashback on the transaction value of the first EMI done within 30 days of card issuance. The maximum cashback that can be earned is capped at Rs. 1,000.

- By spending Rs. 5,000 each month, you can get one complimentary domestic lounge access in the subsequent month. This lounge access is provided to both primary and add-on cardholders.

- 3X Reward Points on select categories like utilities, education, grocery, government, and railway spends.

*Terms and Conditions apply.

2. LIC Select Credit Card

LIC Select Credit Card gives extra bonus points on your transactions for daily usage of the card and paying LIC premiums. These reward points can further be claimed anytime from your credit card account. The reward points can be utilised to pay your next LIC premium. There are also other lifestyle benefits of using the LIC credit card.

LIC Select Credit Card

Joining Fee:

NIL

Best Suited For:

Travel

Renewal Fee:

NIL

Reward Type:

Reward Points

Welcome Benefits:

The card offers 2,000 reward points for spending INR 10,000 within the first month of the card issue.

Key Features

- Free 1-year Lenskart Gold Membership worth Rs. 500.

- Free 6 months PharmEasy Plus Membership worth Rs. 399.

- 5% cashback on the first EMI transaction done within 30 days of card issuance. Maximum cashback is capped at Rs. 1,000.

- ₹500 off on Domestic Flights booking on Yatra.

- The IDFC Select Credit Card offers free access to railway lounges in India.

- This card provides you with the perk of free access to select lounges at airports across India.

*Terms and Conditions apply.

3. LIC Eclat Card by IDBI

LIC Eclat Card by IDBI, as the name suggests is an exclusive credit card which offers incredible rewards and financial facilities to its cardholders. It opens up a source for your national and international travel, offering you a wide range of privileges.

Joining Fee:

NIL

Dining and Travel

Renewal Fee:

NIL

Reward Type:

Reward Points

Welcome Benefits:

The credit card offers 1,500 delight reward points on spending INR 10,000 within 2 months from the issue of the card.

Key Features

- Reward Points: With every Rs.100 spent on the Eclat Select Credit Card, cardholders will earn 4 Delight Points.

- Delight Points are valid for 4 years from the date of issue

- 2x reward points can be availed on renewal or premium of a LIC insurance policy

- Welcome Gift: 1500 Delight Points will be credited on spending Rs.10,000 within 60 days from the date of issuance.

- Fuel Surcharge Waiver: 1% fuel surcharge waiver on transactions of or above Rs.400. A maximum waiver of Rs.300 per month can be availed.

- Easy EMI: Transactions of or above Rs.3,000 can be converted into easy EMIs without any processing fee or foreclosure charges. Cardholders can choose their EMI tenure options of 3, 6, 9 or 12 months as per their requirement.

*Terms and Conditions apply.

4. LIC Lumine Card by IDBI

LIC Lumine Card by IDBI is designed to offer you an exciting experience with your regular spending. It has exciting features and relishes the wide range of offers designed exclusively for you. This card brings you unparalleled privileges to suit your lifestyle and preferences both in India and abroad.

Joining Fee:

NIL

Best Suited For:

Travel and Food

Renewal Fee:

NIL

Reward Type:

Reward Points

Welcome Benefits:

The credit card offers 1,000 delight reward points on spending INR 10,000 within 2 months from the issue of the card.

Key Features

- You will earn 3 reward points for every Rs.100 you spend.

- You get a welcome gift of 1,000 reward points when you spend Rs.10,000 within 60 days from the card being issued.

- You get a Personal Accidental Death Insurance cover of Rs.2 lakh.

- You get Credit Shield Cover.

- You get a 1% fuel surcharge waiver when you spend between Rs.400 and Rs.4,000 on fuel spends.

- In case of loss of IDBI Lumine Platinum Credit Card, report it immediately at IDBI Credit Card Customer Care.

*Terms and Conditions apply.

5. LIC Signature Credit Card

LIC Signature credit card captures the essence of a premium lifestyle and brings an unparalleled range of privileges. It offers maximum rewards on LIC premium payments along with airport lounge access, insurance coverage, fuel benefits, and other benefits.

LIC Signature Credit Card

Joining Fee:

NIL

Best Suited For:

Shopping

Renewal Fee:

NIL

Reward Type:

Reward Points

Welcome Benefits:

It offers complimentary access to selected airport lounges within India for the cardholders.

Key Features

- You get 2 complimentary domestic lounge access every quarter with the LIC Signature Credit Card.

- LIC VISA Signature Credit Card covers a personal accident cover up to Rs. 5 lakh and air accident cover up to Rs. 1 crore.

- You get a 1% fuel surcharge waiver for all fuel transactions between Rs. 400 and Rs. 4,000.

- You also get a card lost insurance cover of up to Rs. 5 lakhs on a LIC VISA Signature Credit Card.

- LIC VISA Signature card lets you earn 2 reward points on every Rs. 150 on LIC premium payments and international transactions using the credit card.

*Terms and Conditions apply.

6. LIC Platinum Credit Card

LIC Platinum Credit Card offers a powerful rewards program. Along with this you get fuel benefits, travel benefits, insurance cover, and more. There are no joining and annual fees for this LIC Platinum credit card for cardholders. The card is best for doing shopping and every transaction offers reward points.

Joining Fee:

NIL

Best Suited:

Shopping

Renewal Fee:

NIL

Reward Type:

Reward Points

Welcome Benefits:

N/A

Key Features

- You can earn 1 reward point on every Rs 100 spent on all categories except fuel transactions, e-wallet loading, and EMI transactions.

- You can simply redeem the reward points accumulated on your LIC Platinum credit card against the LIC Reward catalog.

- You get lost card liability insurance cover up to your respective credit limit

- You get a 1% fuel surcharge waiver for transactions between Rs 400 to Rs 4000 across all fuel stations in India. Maximum surcharge waiver subject to Rs 400 in a month

- No annual fee or renewal fee is charged on this card.

*Terms and Conditions apply.

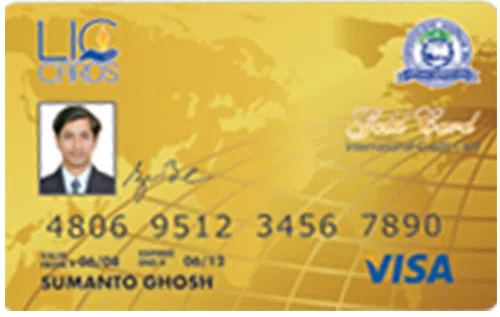

7. LIC Gold EMV Credit Card

LIC Gold EMV Credit Card’s card holders would be able to set their desired credit limits below the assigned credit limits. The cardholder will have the exclusive privilege of transferring balances from an account from another Bank credit card to a credit card account. This option would be made available strictly to the primary cardholder.

Joining Fee:

Nil

Best Suited:

Travel

Renewal Fee:

₹ 999 + GST

Reward Type:

Reward Points

Welcome Benefits:

N/A

Key Features

- LIC Gold EMV card lets you earn 1 reward point on every Rs. 150 on using the credit card.

- You can redeem your reward points against your credit card outstanding on the LIC Gold EMV credit card.

- LIC Gold EMV covers a personal accident cover up to Rs. 1 lakh and a credit shield of upto Rs. 50,000 in case of permanent disability.

- You get a 2.5% fuel surcharge waiver (minimum of Rs. 10) on the LIC Gold EMV credit card.

*Terms and Conditions apply.

LIC Credit Card Features and Benefits

LIC credit cards have various features which differ from one card to another. There are certain benefits associated with these features which allow individuals to opt to apply for LIC credit cards. Let’s see in detail about the features and benefits of the cards:

1. Free Accidental Insurance Coverage: The LIC cardholders receive complimentary accidental insurance coverage for sudden financial crises. Depending on the variations, cardholders can benefit from insurance coverage of up to INR 5 lacs on Signature Card, INR 3 lacs on Platinum Card, and INR 2.5 lacs on Platinum Card.

2. Attractive Reward Points: On spending every INR 100, credit card holders can get attractive reward points. These reward points can later be used for payment of the upcoming premium of LIC. You can earn reward points for spending money on shopping. Moreover, on making international payments, card holders can earn double reward points.

3. Double Reward Points on LIC Premium Payment: LIC credit card holders received 2x reward points on spending money for making payments of LIC premiums. This benefit not only encourages timely payments from card holders but also keeps a good credit score. It holds customers’ loyalty to the company.

4. Airport Lounge Facility: Credit cardholders of Signature cards can take experience of airport lounge access on selected airports within India. It offers relaxing and comfortable travel experiences for cardholders. This airport lounge access is credited twice each quarter and requires a total payment of INR 2.

5. Interest-Free Credit Period: LIC credit card holders receive an interest-free period ranging from 20 to 50 days, which allows cardholders to maintain their finances in a proper manner. This feature provides flexibility and convenience for cardholders to manage finances.

LIC Credit Card Rewards and Cashback

1. LIC Classic Credit Card

- With this credit card, you can earn 6X reward points on making LIC premium payments.

- This card offers 3X reward points for cardholders making payments for utility bills, shopping, and more.

- Also, receive 3X reward points on other spends using the card.

2. LIC Select Credit Card

- You can earn 10X reward points on paying LIC premium payment.

- LIC Select credit card offers 5X reward points on making transactions through the card for daily essentials like dining, utility bills, government payments, education, and other expenses.

3. LIC Eclat Card by IDBI

- LIC Eclat Card by IDBI gives you the chance to earn four delight reward points on every purchase transaction of INR 100.

- Each reward point is equal to INR 0.25.

4. LIC Lumine Card by IDBI

- Earn 3 reward points on sending every INR 100 for daily usage like paying utility bills, government payments, home rent, education bills, and more.

- You also received 2X reward points on making LIC premium payments.

5. LIC Signature Credit Card

- With this credit card, you can earn two reward points on spending money for making LIC premium payments.

- You can also receive 2 reward points on making other purchases except for fuel and EMI transactions.

6. LIC Platinum Credit Card

- Earn two reward points on spending every INR 100 for daily usage and paying the LIC premium amount.

- You can also earn additional reward points for making purchases of various categories excluding fuel and wallet payments.

7. LIC Gold EMV Credit Card

- LIC Gold EMV Credit Card offers reward points on spending international flights and dining.

- This credit card comes with two reward points for spending every INR 100 on utility bills and other categories.

How To Earn and Redeem LIC Credit Card Reward Points?

Earn Credit Card Rewards:

- Rewards Program presents an option of several carefully selected and downloaded rewards to the members of LIC Credit Card.

- To regain the trust of its customers, the program is presented as a way of providing you Reward Points for every rupee spent with your LIC Credit Card.

- Points earned under reward points could be utilised for Home and Lifestyle products, gift vouchers, dining, shopping vouchers and many more.

- Reward points can be earned only against the products listed in the reward catalogue offered by the bank.

Redeem Credit Card Rewards:

- To redeem your reward points from the LIC credit card, you can call their customer care on 1800 419 0064.

- Confirm the product code you want to redeem.

- Choose the quantity and confirm the address of delivery.

- Place a request for the purchase.

- Reward products and gift cards will be delivered through courier to your registered address within 21 working days from the date of redemption.

- You can also receive reward points up to 6X on various products.

- One reward point is equal to INR 0.25 and you can use it for making payments.

LIC Credit Card Eligibility Criteria

There are certain eligibility criteria, and these factors need to be fulfilled by the LIC cardholders to get approval for the cards:

- Age Requirement: The candidates should fit within the age limit of 18 up to the age of 70 years. This helps to check that the holders of the particular credit card are of appropriate age so that they can handle credit responsibilities appropriately.

- Credit History: The other important criterion observed in the case of LIC credit card applicants is the bad/good credit history. In most cases, the lending institutions look at the credit record of an applicant, which encompasses the character, reputation, credit standing, and other factors including payment patterns, other obligations and credit utilisation ratios. A good credit history plays a positive role with regard to the use of the credit limit by proving responsibility towards payment of the credit. This gives a higher chance of acceptance.

- Nationality: The campaign’s applicants must be either a Resident of India or a Non-Resident Indian (NRI). This is a legal conformance criterion which confirms that the applicant, who is applying for credit cards in India, meets the legal requirement of the country with respect to regulations and compliance.

However, it should be mentioned that fulfilling all of the requirements above will significantly increase the probability of approval and at the same time, the bank will be able to approve/reject the application based on additional conditions not listed above only. Hence, applicants should make avail of the laid down eligibility standards and fill the application forms with truthful information to maximise the chances of approval.

Documents Required For LIC Credit Cards Approval

The following documents need to be handy for you when you are willing to apply for a LIC Credit Card.

- Photo-Identity Proof: The facility of applying for a LIC credit card involves mandatory submission for a photocopy of the PAN card. However, in rare circumstances, where PAN itself is not produced while having a PAN number, other photo ID proofs can be filed. All documents which are submitted for the purpose of the KYC must be valid and not expired, as identification documents will not be accepted after their validity period.

- Address Proof: Applicants must provide one of the following as address proof: voters ID, passport or driving licence. Arm permit any of the following documents: Indian Passport, Ration Card, Driving Licence, proof of Address. Utility bills- Electricity, Telephone, Gas, Water, Postpaid mobile bills or house maintenance bills (within the payment date of not more than three months from the date of application), Bank passbook, and others.

- Income Proof: LIC Employees: Duly authenticated Salary slip of last three months or Salary Certificate from the Salary Module of Branch eFEAP program.

- Recent Photographs: You need to submit passport-size photograph for verification purposes.

LIC Credit Card Annual fees

Here’s the complete report on LIC Credit Card annual fees for its customers:

| Card Name | Annual Fee | Renewal Fee Waiver Condition |

|---|---|---|

| LIC Classic Credit Card | No annual fees on the card | N/A |

| LIC Select Credit Card | No annual fees on the card | N/A |

| LIC Eclat Card by IDBI | No annual fees on the card | N/A |

| LIC Lumine Card by IDBI | No annual fees on the card | Spend Rs. 50,000 |

| LIC Signature Credit Card | No annual fees on the card | N/A |

| LIC Platinum Credit Card | No annual fees on the card | N/A |

| LIC Gold EMV Credit Card | No annual fees on the card | N/A |

How to Apply for LIC Credit Cards

- Choose Your LIC Card: Select the LIC Credit Card that best suits your needs.

- Click Apply Now: Click the ‘Apply Now’ button to start the application process.

- Go to Axis LIC Application Page: You will be directed to the Axis LIC application page to continue.

Fill Out the Application Form: Complete the form with your details and submit it to apply for a new LIC Credit Card

How To Activate LIC Credit Cards?

To activate a LIC credit card, you have two options. You can either do it through the assistance of phone banking or through ATM:

Generating LIC Credit Card PIN via Customer Care:

- Step 1: Call the Axis Bank helpline toll-free number, 1800 419 0064, to talk to the customer care executive.

- Step 2: If you are in contact with the TSB Bank customer care centre, they will guide you through a menu where you have to choose the ‘PIN Related service’.

- Step 3: Select the ‘Generate PIN’ option from the available options in the procedures tab.

- Step 4: To ensure that the process is effective, it is advised that all the necessary information, which includes the credit card number, the expiry date of the card, and the registered mobile number, among others as may be asked, be provided with.

- Step 5: After entering your ID and password and getting the OTP (One-Time Password) go to the next step and enter the OTP received on the phone number registered.

- Step 6: Enter a 4-digit PIN for managing your credit card and enter it again to confirm the number.

- Step 7: In the end, after the potentially successful completion of our proposed scenarios, you are going to receive an SMS on your registered mobile number regarding the generation of a credit card PIN.

Through Netbanking:

- Step 1: Log in to your online net banking account using your ID and password.

- Step 2: Now go to the ‘My Credit Cards’ option and choose the card from the drop-down menu.

- Step 3: Select ‘More Services’ and ‘Credit Card PIN change’

- Step 4: Set up a four-digit PIN and enter to confirm.

- Step 5: You will receive a code on your registered mobile number.

- Step 6: Your card will be activated.

LIC Credit Cards Login/Net banking

LIC has a smooth process for net banking of their credit cards. Here’s the detailed net banking process:

- Step 1: Go to the official website of LIC through the link www.licindia.in

- Step 2: Now, find out and click on the customer option on the homepage. This will direct you to the portal’s login page.

- Step 3: As a new user, select the ‘New user’ option to initiate the registration process.

- Step 4: Choose a unique user ID and password that you’ll use to access your account in the future. Ensure your chosen credentials comply with any specified requirements, such as minimum length or character types.

- Step 5: After successfully creating your user ID and password, proceed to log into the portal by entering your newly created credentials into the appropriate fields on the login page.

How to Check LIC Credit Cards Status

- Call the IVR Number: Dial 1800 22 6606 to check your application status.

- Speak to a Customer Representative: Connect with the customer service representative for assistance.

- Provide Your Details: Share your application number, PAN number, and registered mobile number.

- Verification: The customer executive will verify your information and update you on the status.

Bill Payments on LIC Credit Cards

- Pay Through NEFT:

- Log in to your bank’s net banking.

- Add LIC Credit Card as a beneficiary using these details:

- Beneficiary Name: Name on your LIC Credit Card

- Bank Name: Axis Bank

- Branch Name: Mumbai

- Account Number: Your 16-digit LIC Credit Card number

- IFSC Code: UTIB0000400

- Enter the outstanding amount and proceed with payment.

- Pay Using Visa Money Transfer:

- Use your Visa debit card to transfer funds and clear your LIC Credit Card dues.

- Contact your debit card issuer for more details on this service.

How To Compare LIC Credit Cards and Choose The Best One?

LIC credit cards and their selection tips, along with the tips for choosing the best-fit credit card among the different credit card lists available, including how it works, its rewards, its benefits, fees charged, interest rates and its eligibility criteria factors.

Due to the given program’s complexities, it would be wise to look at your spending behaviours, life attitude and inclinations to distinguish the type of Enterprise’s rewards and incentives most suitable for your needs. For instance, if you often travel, you may find the card that has more travel reward options or free access to airport lounges useful more often.

Even critically analyse the rewards programs being offered by each of the LIC credit cards. The list of aspects for judging includes the rate of earning the reward points, the different ways in which the points can be redeemed, cashback offers, insurance coverage, freebies and privileges such as airport lounge access, and the discounts offered by merchants that are affiliated to the credit card.

Annual fees, joining fees, renewal fees, or other charges related to carrying out the particular card should also be compared. When considering fees to charge, it is advisable to compare the fees against the benefits and rewards offered to clients to establish the quality of their rates charges.

Analysing the rewards earned on purchases compared to the fees charged on both cash advances and balance transfers for each credit card. If a user intends to make regular purchases, has an emergency or simply needs to buy something but has no funds without intending to pay the balance in full, they should choose a card with a lower interest rate in order to put off the interest cost.

LIC Credit Card Customer Care

- Call Customer Care: You can contact the bank by calling the helpline number 1800-419-0064 to submit your complaint.

- Submit a Complaint via Email: If you’re not satisfied with the response, you can also send your complaint by emailing [email protected].

Conclusion

LIC credit cards are offered to those who are associated with the company for the purpose of insurance or being an agent. You need to understand the eligibility criteria for each of the credit cards offered by LIC for a better understanding of the card approval. You can get up to 6X reward points on spending through the card for paying LIC premiums and other bills.

FAQs

Q1. How can I earn and redeem reward points on my credit card?

A1. You can earn reward points on your LIC credit card by making purchases of products. You can redeem these reward points from the reward section of the official website.

Q2. What can I do if my credit card is lost?

A2. If you lose your credit card, you need to immediately contact LIC customer care. In such a scenario, you can request the bank to block your card and issue a new card.

Q3. Can I use my LIC credit card for international expenses?

A3. Yes, you can use your LIC credit card for making international payments. But, you should always check card features before applying for one.

Q4. How can I apply for an LIC Credit Card?

A4: Choose the credit card you want for yourself, then click on the ‘Apply Now,’ and fill out the form on the Axis LIC application page.

Q5. How do I check the status of my LIC Credit Card application?

A5. Call 1800 22 6606, provide your application number, PAN number, and registered mobile number, and the customer representative will check it for you.